Saturday March 26, 2022 | LANGFORD, BC

by Mary P Brooke | Island Social Trends

The lowest property inventory on record for the Victoria Real Estate Board (VREB) happened in January — starkly lower than 1,321 one year earlier.

And February wasn’t much better. Even with 14.1 percent more listings, the actual number of active listings was 849 in February. Compared to one year earlier (February 2021) there were 35.6 percent fewer listings at the end of February 2022.

There were 849 active MLS listings at the end of February, compared to 744 active MLS listings at the end of January 2022.

Supply and protecting buyers:

“Inventory levels remain at record lows and without a strong government focus on increasing supply, buyers will continue to face escalating prices and difficult market conditions,” said VREB president Karen Dinnie-Smyth on March 1, in the organization’s usual monthly news release.

Last month the BC Real Estate Association proposed a pre-offer period to help stabilize home-buying process, and hopes the BC government will consider that.

However, the Province said on March 2 that BCREA’s proposed pre-offer still carries risk for homebuyers including encouraging multiple offer situations and having an unknown effect on housing prices.

“We have all also heard the views of mortgage brokers, home inspectors and the experiences of prospective home buyers about taking unfair risks to find a home in a heated market,” the Minister of Finance wrote in a statement to Island Social Trends last month.

“Right now, the province’s real estate regulator is consulting about ways to bring in a cooling off period that could be effective in British Columbia,” the Finance Minister said.

UBCM jumps into housing shortage debate:

On March 23, the Union of BC Municipalities (UBCM) released a study suggesting that housing supply has met demand in British Columbia and that bureaucratic processes and restrictive zoning at the municipal level are not a bottleneck to the creation of new housing.

The report called Building BC: Housing Completions & Population Growth 2016-2021 evidently shows that B.C.’s housing supply is keeping pace with population growth.

UBCM compiled the report within the lens of the common discourse that the housing shortage issue is a matter within the dynamics of supply and demand.

UBCM says “resolving the affordable housing shortage is much more complex than just building more homes”. UBCM claims that “the number of houses being completed in BC closely matches our population growth”.

Between 2016 and 2021, UBCM says the province’s population grew by 7.6 percent, while the number of dwellings grew 7.2 percent. They also claim that data reveals that approvals have “facilitated growth in the number of dwellings that exceeds local population growth”. Apparently that’s 8.2% vs 8.0% for Victoria.

The organization whose membership represents municipalities throughout BC, says that it’s a matter of building the type of housing that is needed to resolve current population conditions.

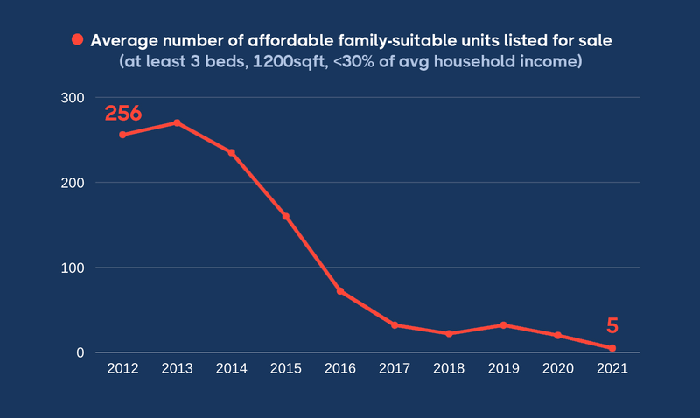

UBCM says that tackling affordability will require incentivizing the right supply including affordable rental housing, co-ops and other forms of attainable housing by addressing the market-skewing influence of speculative demand and not just building “for the sake of supply”. Arguably, the BC NDP government has been saying this one way or another for almost five years. Indeed, UBCM says that statistics show “too much new housing construction is investor-driven and that is contributing to high prices for anyone trying to get into the housing market”.

UBCM advises the need to take on an all-government approach. The Canadian Home Builders’ Association in BC recently noted: “The process to build a home is complex and often requires cross-ministerial involvement.” Other challenges include shortages of qualified professionals, a lack of developers in rural and northern communities, significant trades shortages and supply chain issues.

The BC government has announced various trades-training support initiatives over the past few years. Supply chain issues have been exacerbated in the last two years by pandemic interruptions, and now the global supply chain challenges due to the war in Ukraine are adding to the problem (producing cost pressures on many items).

Lived experience reveals shortage:

The Homes for Living community housing advocacy group said in a commentary this past week that “the same restrictive municipal processes that prevent the construction of market homes also impede non-market and affordable homes”.

Using a method taking into account homelessness, constrained household formation, and job vacancies, the City of Victoria recently estimated in their Sustainable Planning & Community Development report (2021) that there is an immediate shortage of 4,500 to 6,300 homes in that city.

Homes for Living points out: “Municipal processes are not the only barrier to housing, however municipalities have significant control over what and how much housing is constructed. Municipal governments can take decisive action at the local level to reform systems and alleviate the housing shortage. Significant potential reforms include pre-zoning to allow rentals and non-market housing, legalizing missing middle in single family zones, upzoning to match official community plans, restricting short term rentals, and pursuing strategies for directly building social housing.”

A January 2022 Bank of Canada report found more than 20 percent of new home purchases across Canada are made by investors. That produces a lived experience for many people that there’s a housing shortage, i.e. they can’t find anywhere to live that they can afford.

Widening gaps:

The government has actually been working on supply with a wide range of strategies, with their 30-point Homes for BC plan (issued in February 2018) which is expected to roll out over 10 years or more.

It is, in fact, the investor sector keeps pushing up housing prices by using their available funding to buy and resell. Regular homeowners — who buy a house because they want a place to live — are increasingly sidelined by the dynamics of the mainstream real estate market.

The divide between home ownership by regular folks versus people who buy homes as an investment commodity continues to widen quickly. As well, the gap also grows between those who own a home and those who rent.

The BC Plan gets pretty creative. Premier John Horgan frequently mentions how building on-campus student housing will free up secondary-suite rental space in homes in neighbourhoods surrounding university and college campuses. Over 600 new on-campus units are coming to the University of Victoria, as announced early-on the Horgan government, in 2018. UVic students experienced an accommodation crunch upon returning to campus in fall 2021.

February downtrend:

In the February 2022 there were 718 property sales in the VREB system. That’s 18.8 percent fewer properties than the 863 properties that sold in February 2021.

The single family home sales volume at 309 was a decrease of 20.8 percent from the year before. Condo sales at 267 were down by 7.9 percent compared to one year earlier.

Last month Dinnie-Smyth said the market is not slowing down (in terms of interest), it’s just that there’s not a lot of product to sell.

Pandemic housing demand:

At the start of the pandemic in spring 2020 the demand for more spacious living accommodation was high. After the initial pandemic lockdown phase, housing sales burst the seams of the market in spring, summer and fall of 2020.

In 2021 the market limped along in terms of product availability but prices increased throughout the year as people leveraged upon historically-low interest rates (Bank of Canada base rate 0.25%) and also their own savings from not having used as much of their disposal income during 2020 and 2021 (travel, tourism and dining were restricted or disrupted for most of the last 22 months).

In Greater Victoria overall, the average sale price of single family homes as actually sold (not the benchmark data-adjusted figures) in February 2022 was $1,429,618. That’s up in just one month from $1,415,759 as seen in January.

West shore focus:

In Langford, Colwood and Sooke people have been finding homes that are considered relatively affordable compared to the core areas of Victoria, Saanich and Oak Bay.

The price gap between core areas and the west shore closed fast during the last two years of pandemic, with Langford and Colwood single family homes solidly over the $1.2 million mark in January and in February Langford homes sold at a new peak average sale price of $1,319,027. Prices in the once-considered affordable town of Sooke reached an average sale price of $1,231,188 in February. Those figures include waterfront homes.

But the volume of homes for sale is still more ample in the west shore, much of it being new construction which people like (as do their banks and mortgage brokers).

Sale price profile in February 2022:

Here are some average sale price comparisons for single family homes, townhomes and condos in the west shore area. Note that sales volumes are highest in Langford, less so in Colwood, and lower in Sooke.

View Royal prices are closer to the higher Saanich/Oak Bay pricing, which tends to limit sales volumes.

These are the February 2022 sale price averages in the west shore (including waterfront):

| Map Area | Single Family Homes (# sales) | Row/Townhouses (# sales) | Condominiums (# sales) |

| Langford | $1,319,027 (38) | $793,305 (21) | $652,819 (48) |

| Colwood | $1,174,724 (28) | $1,055,250 (8) | $622,433 (3) |

| Sooke | $1,231,188 (25) | $702,467 (6) | $673,750 (4) |

| View Royal | $1,115,000 (7) | $818,333 (6) | $578,400 (8) |

| Greater Victoria | $1,429,618 (294) | $926,157 (80) | $677,918 (266) |

Climate change will change housing demand:

Homes that now include climate-responsive features like heat pumps, geothermal and solar panels, are going to be in increasing demand as the years go by.

Spacious homes are also in demand, as people continue to choose a work-at-home lifestyle and have become conscious of the health benefits of living spaces that aren’t cramped.

As part of ongoing lifestyle and investment sustainability, Realtors are hopefully advising clients on aspects of properties that are climate-change related, such as proximity to flood zones, and overall temperature and seasonal impacts.

Homes of any size that have food-growing options (yard, patio, indoor vertical growing spaces) are likely to be in higher demand over the coming years as well.

===== ABOUT THE WRITER:

Mary P Brooke has been following trends of the real estate market and the news of south Vancouver Island municipalities for over 14 years in the south Vancouver Island region. She is the editor and publisher of Island Social Trends.