Friday June 5, 2020 ~ VICTORIA, BC

by Mary Brooke ~ West Shore Voice News

The gig economy, working from home, and home-based business is a large part of the British Columbia economy and is ‘here to stay’, it was indicated by BC Finance Minister Carole James today June 5 in her media session from the press theatre in Victoria.

Minister James was commenting on the Statistics Canada’s Labour Force Survey for May 2020. “Today’s survey reflects job and employment information that was collected during the week of May 10 to May 16, before B.C.’s gradual reopening had fully begun,” it was stated.

“In the coming months we hope to see further positive results as our economic recovery begins to take shape.”

Today’s report on unemployment numbers and job losses during the early phases of COVID-19 showed 353,000 jobs lost since the pandemic began (150,000 of those among youth).

What is gig-work?

The Statistic Canada definition of gig work is “usually independent contractors hired for short-term jobs, including freelancers as well as on-demand workers hired for jobs through the growing number of online platforms”.

According to Statistic Canada (2016 figures), more than half of all gig workers also had one or more wage jobs. But that is likely to have changed by 2020 especially in light of more fluency with and the speed of Internet technologies, and even more so since the onset of the COVID pandemic.

How many gig workers?

No current figures for gig economy or home-based activity were indicated in today’s presentation of BC job numbers.

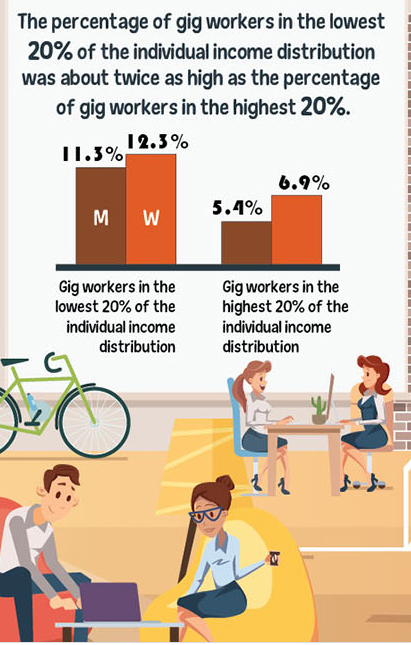

However, Statistics Canada figures as of 2016 show that across Canada, the number of gig workers age 15+ grew from 5.5% to 8.2% during 2005 to 2016.

Notably, BC had the country’s highest share of gig workers as of 2016, with 10.7% of women workers in that sector and 8.7% of men (compared to 9.8%W/7.5%M in Quebec, 8.9%W/8.0%M in Ontario, and 8.5%W/5.6%M in the prairie provinces).

More gig workers are in the lowest 20% of individual income than in higher income demographics.

These figures do not include the shift of workers from social workplace to home-based during COVID-19, and neither are home-based business owner/operators distinctly represented in these numbers.

Gig and home-based — temporary or entrenched:

West Shore Voice News asked Minister James today about the prevalence and strength of the gig economy, working from home, and home-based business.

The question was about whether (in the context of mid-pandemic economic recovery) that BC will be encouraging workers in those tracks to get back into the mainstream job market. To which Minister James replied:

“Everybody has to make their own decision. There’s no question that the gig economy is a large part of British Columbia. You talk to people who are in arts and culture for example, or tech — there are many folks who have created small businesses over this time period at home, or shifted their business to home to be able to operate,” she said.

“So that’s really a choice each individual has to make when they’re looking at economic recovery and their own circumstances and their own families,” said Minister James regarding whether any shift to gig or home-based during the COVID-19 will be temporary or long-lasting.

“I expect it to continue to be a large part of British Columbia’s burgeoning economy and economic recovery,” said Minister James.

Small business sector is strong in BC:

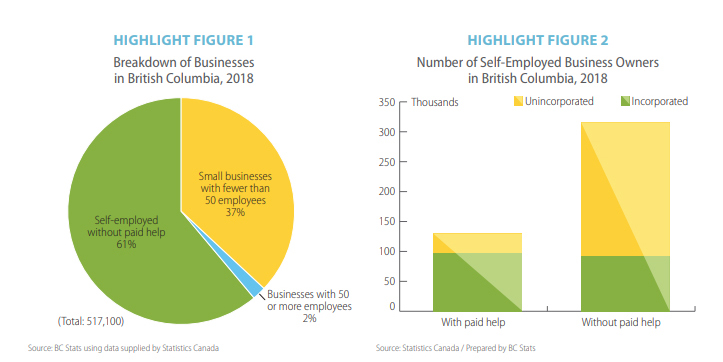

In BC in 2018 the small business profile was robust. There were 508,700 small businesses. Nearly 1.1 million people worked in small businesses. Small business payrolls in BC accounted for 32% of all wages paid to workers that year.

Of self-employed business owners in BC (2018), about 113,200 operated with paid help (defined as having 1 to 4 employees), and 315,200 (or 61%) without paid help (but that could have included gig and contract worker activity).

Standing up for contract, gig and home-based workers during COVID-19:

“Certainly when it came to the benefits for COVID-19, we in fact pushed the federal government to make sure that they were recognizing the gig economic, people on short term contracts, people who were simply working on contracted work,” said Minister James today.

“We were pleased to see a lot of that was actually included in the benefits that were there,” indicating the impact BC has had for workers in this province and across Canada.

“I’m certain it will be part of our discussion around economic recovery,” said James, which is a positive sign for those who have made a commitment to gig, home-based work and home-based business going forward.

“I know the industries themselves are putting together some ideas and approaches to strengthen their industries as well,” said James, without yet specifying which sectors.

Shifting back to the traditional workplace:

Meanwhile, the finance minister indicated that she was pleased to see that some people are shifting back into the workforce after the worst of the impacts of COVID-19.

Provincial Health Officer orders and the overall pandemic plan in BC required people to self-isolate at home and do physical distancing — much of that leading to massive economic shutdown as in most cases businesses could not operate effectively under those conditions.

Of course the goal was to prevent community spread of the COVID-19 virus by ‘flattening the curve’, which obviously almost all British Columbians complied with (see latest BC Centre for Disease Control data modelling, released June 4).

The most significant impacts on the BC economy were in the shutdown period of mid-March through mid-May. BC is still officially in a State of Emergency (presently to June 9, but Premier Horgan indicated on May 27 that the end ‘is nowhere in sight’).

Now in today’s job numbers it was seen that more than 43,300 people “shifted back into the labour market”, she said, after COVID-19 having caused “disruption for every sector”.

The employment numbers released today include the period of May 10 to 16 “before gradual reopening began”, Minister James pointed out.

Hardest hit by COVID-19:

The impacted sectors are a reflection for youth in particular of who is “suffering the most”, said James, noting job losses in accommodation, food service, wholesale and retail, where 46% of jobs have been lost.

“We have to remember, those numbers are families, individuals and businesses who have really struggled and are continuing to struggle,” said James, adding that BC has put supports in place through the COVID action plan to recognize those impacts.

Supports for individuals have included rent subsidies (including a freeze on rent increases and a ban on rent evictions) which saw a very strong uptake, an emergency worker benefit (as a top-up to the federal CERB) which saw more than 521,000 British Columbians receive a one-time $1,000 payment (though 533,764 were approved, was a figure provided by the Finance Ministry earlier this week), and a top up for people on disability and low-income supports.

For businesses, organizations and industry the supports have included access to credit, avoiding layoffs and rehiring employees, bill relief, deferred payments, child care, property owners & landlords, and communities that are rural, remote or indigenous. Specific sectors addressed included arts, restaurants/breweries, forestry, sports and transportation.

===== LINKS:

BC Finance Minister’s statement on May Labour Force Survey results (June 5, 2020)

Benefits for British Columbians during COVID-19 (last update June 4, 2020)