Wednesday December 10, 2025 | NATIONAL [Reporting from VICTORIA, BC]

by Mary P Brooke | Island Social Trends

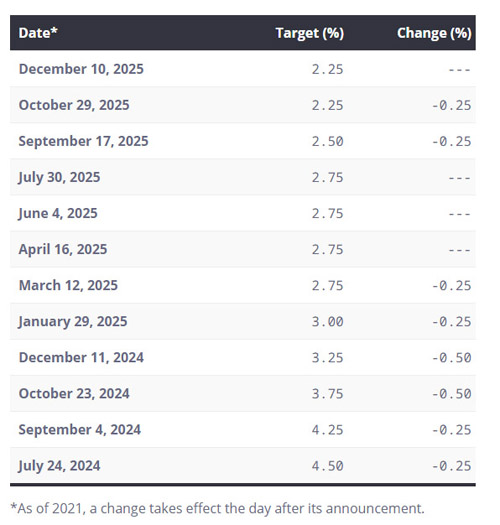

The Bank of Canada today announced that their overnight interest rate will remain at 2.25%. The Bank Rate is at 2.5% and the deposit rate at 2.20%.

There wasn’t a whole lot of speculation ahead of today’s announcement. Inflation is stable and the economy is resilient overall, said Bank of Canada Governor Tiff Macklem today. Most observers felt the rate would remain unchanged.

However, the range of possible outcomes is wider than usual, said Macklem.

Canada’s economy grew by a surprisingly strong 2.6% in the third quarter, even as final domestic demand was flat. Hiring intentions are muted, said Macklem.

Economic uncertainty due to the US trade war pressures on Canada is part of why things will remain stable for the foreseeable future.

“The economy is working through a structural transition,” said Macklem, even while he welcomes the “resilience” being shown in the economy (though some of that is due to weak imports). There is a need for more posts and a pipeline, and more trade diversification, he said.

Interest rate profile:

The rate is expected to remain at the current level for several months, possibly through all of 2026.

Uncertainty:

Uncertainty remains elevated, says the Bank of Canada’s governing council: “This includes the unpredictability of US trade policy. In particular, the upcoming review of the Canada-United States-Mexico Agreement is creating uncertainty for many businesses. There is also uncertainty about how the Canadian economy will adjust to higher tariffs. The volatility we’re seeing in trade and quarterly GDP make it more difficult to assess the underlying momentum of the economy.”

Our economy works less efficiently amidst uncertainty, Macklem pointed out.

Three main messages:

Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers had three main messages in their monetary announcement today:

- First, steep US tariffs on steel, aluminum, autos and lumber have hit these sectors hard, and uncertainty about US trade policy is weighing on business investment more broadly. But so far, the economy is proving resilient overall.

- Second, inflationary pressures continue to be contained despite added costs related to the reconfiguration of trade. Total CPI inflation has been close to the 2% target for more than a year now, and we expect it to remain near the target.

- Third, in the current situation, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. Nevertheless, uncertainty remains high and the range of possible outcomes is wider than usual. If the outlook changes, we are prepared to respond.

Message to Canadians at Christmas season:

“Inflation has come back down but prices have not,” said Macklem. He said that inflation should be kept low so that incomes can keep up.

“We’re not going to lower prices overall, that would cause a severe recession in Canada. Nobody wants that,” the Bank of Canada governor said.

He emphasized that growing income is the way to improve productivity in the economy — that will make things more affordable, said Macklem.

Food and shelter prices still “loom large” for Canadians, said Senior Deputy Governor Carolyn Rogers. She said that prices come down when the economy is struggling. Wage increases happen when productivity is greater.

Announcements in 2026:

The next scheduled date for announcing the overnight rate target is January 28, 2026.

The scheduled interest rate announcement dates for 2026 are:

- Wednesday, January 28

- Wednesday, March 18

- Wednesday, April 29

- Wednesday, June 10

- Wednesday, July 15

- Wednesday, September 2

- Wednesday, October 28

- Wednesday, December 9

===== RELATED:

NEWS SECTIONS: BANK OF CANADA | BUSINESS & ECONOMY | TRADE & TARIFFS