Saturday August 1, 2020 ~ NATIONAL

by Mary Brooke, editor ~ West Shore Voice News

Over eight million people have relied on the Canada Emergency Response Benefit (CERB) since the beginning of the pandemic. For many who are still claiming the CERB there has been concern as to their financial stability going forward, as the program was to be coming to an end by early September.

The CERB pays $2,000 per 4-week period, for eligible recipients. A person is allowed up to six 4-week periods. That has seen most people claiming for periods bridging 4-week periods in March, April, May, June, July and soon August and a bit in September, depending on when a person applied.

As of July 26, more than 8.4 million Canadians had applied for CERB, with numbers decreasing as businesses have reopened in various provinces under a range of Restart programs.

However, people still requiring the income boost will be transitioned onto the federal Employment Insurance (EI) program in September, the federal government announced on Friday July 31.

Trudeau announced the shift to EI, more details to come:

Prime Minister Justin Trudeau said that more details will be coming before the end of August, but said that “no one will be left behind”, referring specifically to contract and gig workers (which one presumes also includes self-employed people) in addition to those who have payroll income as employees of businesses.

Trudeau referred to the new program as being a “better 21st century EI system” intended to cover “every Canadian who is looking for work”. That implies more strident qualifications than the CERB, which essentially was paid out on an honour-system under the duress of the early phases of the pandemic.

“For those who don’t qualify for EI right now, like gig or contract workers, we will create a transitional parallel benefit that is similar to employment insurance,” said Trudeau.

More details are to come by the end of August, the prime minister said on Friday.

Transition process:

Minister of Employment, Workforce Development and Disability Inclusion, Carla Qualtrough (MP for Delta), said on July 31 that the transfer of CERB recipients will occur in September, saying that federal officials have worked to streamline intake procedures for accepting claims in the older EI system, with the help of existing employment records built over the past five months.

When the pandemic first hit, the EI system was unable to accommodate the load of millions of new recipients, and had no way to accommodate gig, contract, and self-employed workers. Hence the eventual simplicity of CERB for all applicants, in response to pressure from opposition parties (NDP, Conservatives, and Bloc).

The new system will apparently require everyone to pay into EI in some manner, which will be new for gig and contract workers and some self-employed people.

Benefits to students:

Students over age 15 also presently are also eligible for a form of emergency benefit called the Canadian Emergency Student Benefit (CESB) which offers the same amount as the CERB (i.e. $2,000 per 4-week period) if the student has dependents, otherwise the amount is $1,250 per 4-week period. Post-secondary students are also eligible for various access grants and there has been a deferral in place for payments on student loans.

CERB has gone through transitions:

This is the second round of transition for CERB recipients. The program started in April (being retroactive into mid-March which was when the instructions of public health drove people into hiding in their homes during Phase 1 of the COVID-19 pandemic), but in mid-June the government announced CERB would be extended to the end of the summer. Now with that on the horizon people were getting worried. The federal government has in response begun to lay out what recipients should expect.

CERB wasn’t always set at $2,000 per month. That amount was fought for hard by the NDP opposition party in the House of Commons in the spring, citing the need to provide essentially a basic livable income to help people cover rent, groceries, child care and other necessities.

CERB has helped, but inequities may emerge:

The CERB amount has been a flat amount to all recipients. By comparison, people who did successfully apply for help during COVID-19 through EI (i.e. they were previously paid as employees, not as gig, contract or self-employed) in many cases received more than $2,000 per month, based on a percentage of whatever they were earning pre-COVID.

CERB is taxable:

To date, CERB has paid out over $62 billion. CERB payments are taxable, and if received in error will be clawed back at tax time. Debate in the House of Commons a few months ago saw the opposition parties preventing a criminal process being applied to people who should not have received CERB (which the Liberals were pushing for).

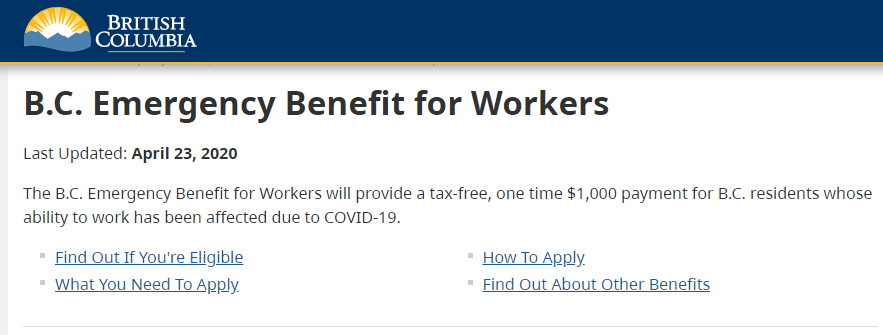

BC top-up is not taxable:

In BC there was also a CERB top up of $1,000 per worker announced in May, which has since been received by over 400,000 British Columbians. The BC Emergency Benefit for Workers is not taxable. Workers can still apply up to December 2, 2020.

![Hon John Horgan, MLA [Langford-Juan de Fuca]](https://islandsocialtrends.ca/wp-content/uploads/2020/04/LFDJdFConstituency-WSVN-covid-banner-728x90-web.jpg)