Monday January 26, 2026 | OTTAWA, ON [Posted at 3:57 pm PT / Updated 7 & 11:20 pm | Reporting from VICTORIA, BC]

Political and economic news by Mary P Brooke | Island Social Trends

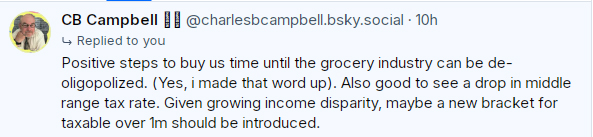

New measures to make life more affordable for Canadians was the topic of Prime Minister Mark Carney’s news announcement on this first day back in the House of Commons.

After a six-week break in December and early January, members of parliament have returned to Ottawa for the Winter/Spring session which runs to mid-June.

“We”re starting to fundamental transform our economy,” said Carney in his announcement at a grocery store in Ottawa.

“Canadians need a boost today and a bridge to tomorrow,” said Carney.

Today’s announcement at 9 am local time in Ottawa (6 am Pacific) was the start of a jam-packed day for Carney who also met with Ontario Premier Doug Ford in Toronto, where together they also visited a local business.

Liberal government strategy:

The food affordability focus is being tackled on three levels, to provide greater resilience to price shocks for things like groceries and other life essentials:

- macro – create more career opportunities and higher wages, to boost household incomes; in some cases there will be job shifts as new technologies replace the old.

- sector specific – managing grocery prices and developing more support for food security enterprise and systems.

- micro – putting money directly into the bank accounts of lower-income households, under the banner of a “Canada Groceries and Essentials Benefit”, to provide more certainty, security, and prosperity in the short term.

Finance Minister frames the announcement:

So that households can “live, work and plan for the future”, some new measures were introduced by the federal government today.

The investment will be more than $1 trillion by 2030, said François-Philippe Champagne, Minister of Finance and National Revenue today.

The short-term provides support while the long-term efforts kick in.

“The biggest payoffs in our plan will take time. However, we recognise that many Canadians are feeling the pressures of everyday expenses and need relief right now,” it was stated on the federal government’s information page about the new Canada Groceries and Essentials Benefit.

Focus on food:

“Many Canadians have been feeling the pressure of rising costs for far too long, and our government is focused on delivering support where it’s needed most,” says Heath MacDonald, Minister of Agriculture and Agri-Food.

“These measures will support Canada’s agriculture sector and strengthen the systems Canadians rely on every day. By taking action now, we’re helping families manage essential costs, improving food affordability, and strengthening a more resilient food system,” says MacDonald.

Immediate measures:

To ensure Canadians have the support they need right now, the government has introduced a series of new measures to bring down costs – including cutting taxes for 22 million Canadians, supercharging homebuilding, and protecting and expanding vital social programs.

“The cost of groceries and essentials has been too high for too long,” said Carney today, including housing costs in that calculation.

To build on that progress, the Prime Minister, Mark Carney in his first announcement of the Winter/Spring 2026 session, today introduced new measures to make groceries and other essentials more affordable. The benefits are income-tested (based on people’s income tax returns).

“we’re focused on results for Canadians,” said Carney today.

- Putting more money back in Canadians’ pockets

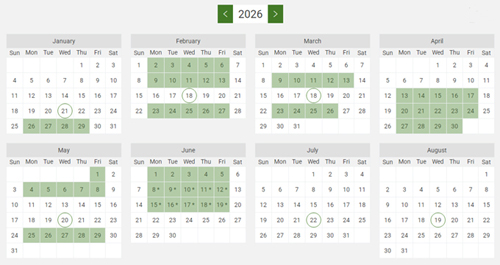

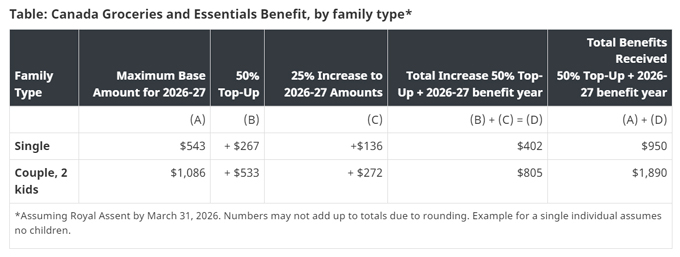

- The government is introducing the new Canada Groceries and Essentials Benefit – formerly the Goods and Services Tax (GST) Credit. The amount will be increased by 25% for five years beginning in July 2026.

- In addition, for about 12 million Canadians, there will be a one-time payment, equivalent to a 50% increase this year.

- Combined, it means that a family of four will receive up to $1,890 this year, and about $1,400 a year for the next four years; a single person will receive up to $950 this year, and about $700 a year for the next four years.

- These changes require passage of legislation in the House of Commons, which underscores the significance of the Liberal government operating just short of a majority of seats (currently 170 of 343 MPs); the Conservative Leader said today his MPs will support the bill.

- The program cost was outlined by Carney today: the cost will be $3.1 billion in the first year (which includes the boost which makes up for the difference in food inflation), then $1.3 billion in the second year, and then $1.8 billion per year for the last three years of the five-year package.

- Reinforcing the competition bureau’s oversight of the industry as a whole will help prevent grocers and their suppliers from boosting product prices just because they possibly could.

- Tackling food insecurity, supporting producers, and strengthening supply chains

- The government is setting aside $500 million from the Strategic Response Fund to help businesses address the costs of supply chain disruptions without passing those costs on to Canadians at the checkout line.

- For the same purpose, the government will create a $150 million Food Security Fund under the existing Regional Tariff Response Initiative for small and medium enterprises and the organisations that support them.

- To lower the cost of food production, there is now immediate expensing for greenhouse buildings. This allows producers to fully write off greenhouses acquired on or after November 4, 2025, and that become available for use before 2030. This measure supports increased domestic supply and investment in food production over the medium-term.

- To ease immediate pressures with food banks, the government is providing $20 million to the Local Food Infrastructure Fund. This supports food banks and other national, regional, and local organisations to deliver more nutritious food to families in need.

- To tackle the root causes of food insecurity, we are developing a National Food Security Strategy – one that strengthens domestic food production and improves access to affordable, nutritious food.

- This strategy will also include measures to implement unit price labelling and support the work of the Competition Bureau in monitoring and enforcing competition in the market, including food supply chains.

The affordability issue head-on:

“The global landscape is rapidly changing, leaving economies, businesses, and workers under a cloud of uncertainty,” said Prime Minister Carney today.

In response, Canada’s new government says it is focused on what can be controlled at home toward building a stronger economy to make life more affordable for Canadians.

To that end, the federal government is securing new trade and investment partnerships abroad and building the strength of the domestic economy. The goal is to create good career opportunities with higher wages for Canadians as part of overall better functioning of the economy, including affordability.

Resilience for long-term payoffs:

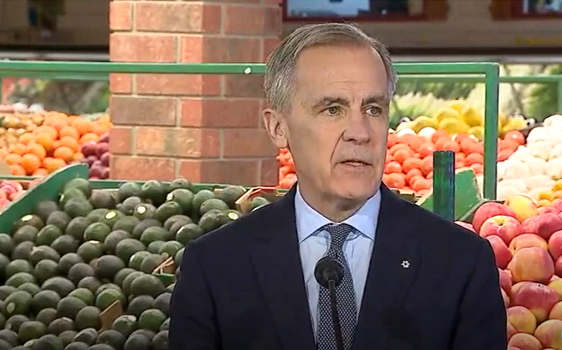

The federal goverment plan is about moving Canada’s economy from reliance to resilience, said Carney today.

He cautions that some of the biggest long-term payoffs of this transformation will take time to be recognized and felt, as he manages a macroeconomic approach to steadying and strengthening the Canadian economy that is in backlash from impacts brought on by the US Trump administration.

Reader comments:

Some Island Social Trends readers have great input on the new grocery rebate, including that most of the money will go back into the local economy or at least the current economy (e.g. paying bills).

Another reader remarks on the shuffling funds within the current system while not seeing any tax increases on large corporations and top 1% earners.

Another reader appreciates the short-term support while the broader grocery system is being restructured, and also mentions about taxing millionaires more.

Related overall Budget 2025 details:

- Today’s announcement builds on the following measures to lower costs for Canadians and protect essential programs, including:

- Cutting taxes for 22 million middle-class Canadians by lowering the first marginal personal income tax rate from 15% to 14% as of July 1, 2025, providing tax relief of up to $420 a year per person, or up to $840 a year for two-income families.

- Eliminating the Goods and Services Tax (GST) for first-time homebuyers on new homes up to $1 million and reducing the GST for first-time home buyers on new homes between $1 million and $1.5 million, to immediately make the goal of home ownership a reality for more Canadians, especially young families.

- Cancelling the federal consumer carbon tax effective April 1, 2025, directly helping Canadians save money at the pump. The government also removed the requirement for provinces and territories to have a consumer-facing carbon price as of that date. This has helped reduce gas prices in most provinces and territories by up to 18 cents per litre in comparison to 2024-25, lowering headline inflation. [However, it should be noted that cancelling the redistribution aspect of the consumer carbon tax meant that low-and-moderate income Canadians went without the quarterly rebates they received along with their GST rebates.]

- Budget 2025 also outlined concrete action to ensure Canadians receive the support they deserve, including targeted measures to strengthen food security and household affordability:

- Making the National School Food Program permanent, providing school meals for up to 400,000 children each year, saving participating families with two children in school an estimated $800 annually on groceries.

- Introducing Automatic Federal Benefits, starting in the 2026 tax year, to ensure up to 5.5 million low-income Canadians automatically receive the benefits they qualify for by the 2028 tax year, including the Canada Groceries and Essentials Benefit and the Canada Child Benefit.

- Lowering costs and strengthening competition in essential services, including ambitious pro-competition measures in the telecom and financial sectors to reduce prices, make it easier for Canadians to switch providers, andlower banking and service fees.

- More information on Budget 2025 measures to tackle affordability is online.

Political scope:

Many of the principles of fair-play for all Canadians and a recognition of social supports like child care and the national school food program comes from the many years of NDP influence on the Liberal government.

The Liberals are adept at absorbing NDP ideas into their own framework. This benefits Canadians so long as the Liberals hold government.

The impact of today’s grocery-support announcement will likely be highly positive for the Liberals as they move forward in Mark Carney’s first term.

===== RELATED:

NEWS SECTIONS: FOOD SECURITY | 45th PARLIAMENT of CANADA