Thursday November 27, 2025 | VICTORIA, BC [Posted at 3:11 pm PT]

by Mary P Brooke | Island Social Trends

Today BC Finance Minister Brenda Bailey released and presented the province’s second quarterly report.

She continues to highlight “unjust and unpredictable trade policies” that have upended global relationships and shaken investor confidence around the world.

Meanwhile, BC is resilient. Here is the overall summary:

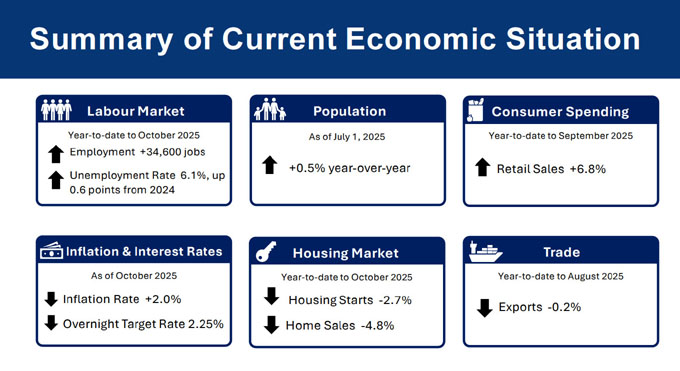

- B.C. is projected to see economic growth of 1.4% in 2025 and 1.3% in 2026

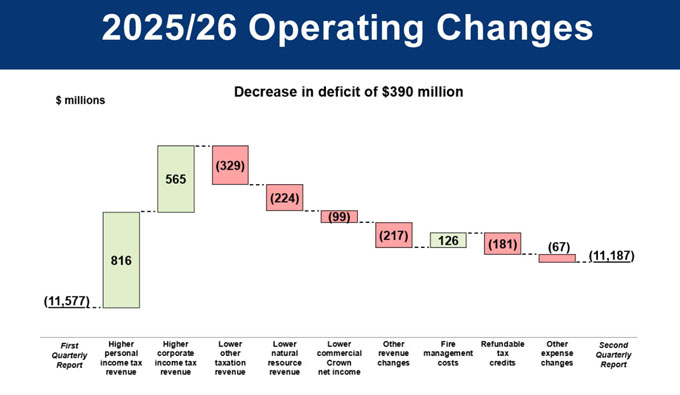

- Deficit for 2025-26 projected at $11.2 billion

- Province continues to invest in supporting good jobs and building key infrastructure

Minister’s remarks:

“It continues to be a challenging year. People and resources built the economic engine of Canada’s new economy,” said Finance Minister Bailey today.

She reminds that fiscal reports are “always a snapshot in time” and that it’s “especially true of today’s presentation”, which is dated November 21, 2025. Meanwhile, she says that “many of projections from earlier this year remain accurate”.

BC’s advantages continue to be: resources, geographical advantage and skilled workforce.

Four of the federal government’s list of 11 national major projects are in BC. Bailey says that helps BC build its economic sovereignty.

The secondary quarter deficit shows as $11.2 billion which is $320 million lower than in the first quarterly report.

Jobs:

The number of jobs was up by 34,600 in the first 10 months of 2025 compared to last year. Bailey points out that is a mix of full-time and part-time.

The gains were led by the private sector where the finance minister says there is innovation and resilience.

In this year, so far 1,085 fewer people are working in the public service (full and part time), equivalent to 700 FTEs. Bailey says that 94% of the unfilled jobs are a result of attrition (retirement and voluntary departure).

Retail sales – up or down?

Last quarter, Bailey said she expected retail sales to be lower in the second quarterly report. And she still expects that to be the case as more numbers roll in for 2025.

However, the figures show as higher. She said today (as she did in her first quarterly comments a few months ago) that the ‘sales rush’ was about reflect people rushing to buy big ticket items before the US-imposed tariffs kicked in on things like cars and appliances — all of that was pre-April, said Bailey today.

PST revenue for this current year down from the Budget expectation, but shows 3% growth year over year.

Tobacco tax revenues are lower year-to-date. Bailey said the province is aware that when tobacco taxes go up that ‘off sale market’ sales might increase. “There is a lot of work going on with that file,” she said.

Exports:

Exports to China and US are up.

On a volume basis exports are up for copper, natural gas and coal, while forest product exports are down.

Income tax revenues:

BC expects to collect more from personal and business income taxes than previously forecast this year. Property purchase tax (PPT) and sales taxes are expected to decline.

Net income of crown corporations is down — largely due to impacts of the BCGEU labour strike. But what might have been a one-time payroll savings has been offset by reductions in net income due to lost liquor sales. BC Liquor Distribution Branch employees are now working overtime so that stores can catch up — and that is balancing off any patroll savings.

There has been higher spending on refundable tax credits.

Wildfire management costs:

Wildfire management spending is currently at $725 million for 2025 — that’s $126 million lower than forecast at Q1.

This year is coming is as the third-highest wildfire expenditure year; 2024 was the second highest and 2023 was the highest, said Bailey today.

Debt and looking forward:

“The interest bite is five cents on the dollar,” the Finance Minister said today.

“What will guide us through is our commitment to people — protecting working families and the most vulnerable members of our communities,” said Bailey today. This is distinctively an NDP approach to government.

Capital plan:

BC is continuing to build important infrastructure including schools and hospitals.

New major projects include Simcoe Elementary School ($65 million); Simon Fraser University medical school ($521 million), and the Plant and Animal Health Centre ($496 million).

Taxpayer-suppoted capital spending is forecasted at $13.9 billion in 2025/26 — that $763 million lower than the First Quarterly Report, primarily due to changes in the timing of capital spending in the health and transportation sectors.

Inefficiencies:

The government is continuing to review expenditures to idenitfy areas of inefficiency.

The goal was to target 300 review in year 1; 600 in year 2; and 600 in year 3.

Inefficiencies are being found in travel — meetings are instead being attended online more often. There is a reduction in the use of contractors and some land leases have be dropped.

“That work is continuing,” said Finance Minister Bailey today.

Getting prepared for Budget 2026:

The Finance Ministry is working on budget preparations for next year. Part of that process includes meeting with an independent Economic Outlook Council in December each year — to get their take on where things may be heading in the broader economy and how that might impact or be interpreted for BC.

For our readers, Island Social Trends as media has attended some of those EOC meetings in previous years, and will again this year.

===== RELATED:

NEWS SECTIONS: BUSINESS & ECONOMY | BC 43rd PARLIAMENT | BUDGET 2025 | MAJOR NATIONAL PROJECTS | TRADE DIVERSIFICATION | ENERGY SECTOR | JOBS & EMPLOYMENT