Tuesday, February 19, 2019 ~ BC.

In an NDP Government budget that was expected to deliver loads of moves toward more affordability for people in BC, there were lots of pieces to that shifting puzzle.

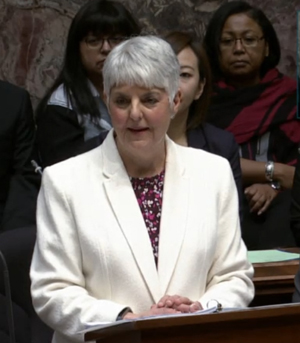

“Budget 2019 is creating opportunities for all British Columbians by delivering a new B.C. Child Opportunity Benefit for kids up to the age of 18, removing interest from B.C. student loans, reducing taxes for businesses and investing in clean energy and climate solutions,” was the official summary today after Finance Minister Carole James delivered the budget in the BC Legislature after 1:30 pm.

“Budget 2019 makes historic investments in people and balances the budget in all three years of the fiscal plan with surpluses of $274 million in 2019-20, $287 million in 2020-21, and $585 million in 2021-22,”is the top line summary.

“People in B.C. struggled for too long because the old government made choices that helped the few at the top while everyone else fell further and further behind,” said Minister James. “Budget 2019 opens doors for you and your family by putting thousands of dollars back into your pocket. We’re helping hard-working British Columbians get ahead at every stage of their life, no matter where they’re starting from.”

BC Child Opportunity Benefit: To make life more affordable for families and help every child reach their full potential, Budget 2019 introduces the B.C. Child Opportunity Benefit, directly returning nearly $400 million to British Columbian families raising children, starting October 2020. For a family’s first child, the benefit is as high as $1,600 a year, increasing to $2,600 for two children and $3,400 for three children. Families will receive the B.C. Child Opportunity Benefit from the day their child is born until reaching 18 years of age.

Income Tax Reduction: This benefit, along with the full elimination of Medical Service Plan (MSP) premiums, will give middle-class families the largest reduction in their taxes in a generation:

* A family of four earning $60,000 will have its provincial taxes reduced by up to 60%, compared to 2016, putting more than $2,500 back into this family’s pocket.

* A family of four earning $80,000 will have its provincial taxes reduced by up to 43%, compared to 2016, putting almost $2,400 back into this family’s pocket.

* A family of four earning $100,000 will have its provincial taxes reduced by up to 22%, compared to 2016, putting almost $1,600 back into this family’s pocket.

Elimination of Interest on Student Loans: To help make sure young people are able to start their careers without being saddled with debt, Budget 2019 eliminates interest from all new and existing British Columbia student loans. As of today, all B.C. student loans will stop accumulating interest. This means an average graduate would save $2,300 in interest, based on a $28,000 combined federal and provincial loan with a 10-year repayment period.

Reconciliation: Budget 2019 deepens the Province’s commitment to achieving true and lasting reconciliation with Indigenous peoples, committing an estimated $3 billion over the next 25 years for the largest revenue-sharing agreement with First Nations in B.C.’s history.

Environment: This year’s budget moves forward with CleanBC by investing $902 million to make sure B.C. can meet its climate commitments and to protect the province’s clean air, land and water. This initiative was developed in consultation with the B.C. Green Party caucus as committed to in the Confidence and Supply Agreement.

Said BC Green Party Leader Andrew Weaver today: “We are pleased the B.C. Green Caucus’ impact on this budget is so evident,” said MLA Andrew Weaver. “By funding core B.C. Green initiatives, including CleanBC, professional reliance reform, and increasing affordability for students, government demonstrates the value of our voice in a minority government.”

Economy: “British Columbia’s economy is thriving with the strongest GDP and wage growth in Canada. It’s clear that sharing the benefits of growth with all British Columbians results in a stronger economy,” said James. “Together we are doing our part to fight climate change and build a British Columbia where everyone can enjoy a good life and secure future in the community they call home.”

Infrastructure: To support British Columbia’s long-term economic growth, government is investing $20 billion over three years to build the infrastructure B.C. needs to thrive, creating and supporting tens of thousands of good-paying jobs.

Business Tax Reduction: Further, the Province is moving forward with more than $800 million in business tax reductions over the course of the fiscal plan to support investment in new plants, machinery and equipment, joining with the Government of Canada to boost B.C.’s competitiveness.

Working toward future goals: Budget 2019 continues to invest in better services for people, including improved health care, quality education and affordable, accessible child care. As priorities, government is delivering more hospitals and shorter wait times, funding schools and thousands of new teachers, and continuing the path towards a universal, made-in-B.C. child care program.

Making life more affordable:

* Introducing the new B.C. Child Opportunity Benefit – starting in October 2020 – that will provide families with one child up to $1,600 per year, two children up to $2,600 and three children up to $3,400. Over the course of a child’s upbringing, families with one child will receive as much as $28,800. For families with two children, that number can exceed $40,000 in support.

* Eliminating interest on British Columbia student loans. As of Feb. 19, 2019, all B.C. student loans will stop accumulating interest; saving someone with $28,000 in combined provincial and federal student loans $2,300 over the 10-year repayment period.

* Fully eliminating MSP premiums on Jan. 1, 2020, saving families as much as $1,800 per year.

* Increasing income and disability assistance rates by an additional $50 per month, meaning a total increase of $150 per month, or $1,800 per year since Budget Update 2017.

* Investing $26 million in income and disability assistance enhancements to the B.C. Employment Assistance program to help remove barriers to accessing support, such as removing requirements that make it harder for older adults, youth and persons with mental-health issues to access the program; helping people get identification so they can access income assistance; and extending the shelter rate for those paying room and board to a family member.

* Investing $6 million annually to provide respite services for parents who provide care for children with disabilities. This will significantly reduce the waitlist for respite services and increase the respite benefit by 10%.

* Investing $85 million to support children in care by increasing support payments for foster parents, adoptive parents and extended family members caring for children and by ensuring children in care benefit from provincial tax benefits. This includes a 75% increase to support payments for the Extended Family Program and responds to recommendations from Indigenous communities and Grand Chief Ed John’s report.

* Providing funding to community organizations to operate rent banks by providing short-term loans with little to no interest to low-income tenants who can’t pay their rent due to a financial crisis.

* Introducing a homelessness action plan with a $76-million investment that will support land acquisition and services to bring the number of modular homes for people who need them to 2,200.

Delivering better services for families:

* Investing $4.4 billion over three years to expand and upgrade hospitals, medical and diagnostic equipment and health information management systems to ensure patients have the quality care they deserve.

* Providing $105 million over three years to support life-saving cancer care services delivered by the BC Cancer Agency, including increasing the number of cancer-related surgeries, diagnostic imaging, PET and CT scans.

* Improving mental-health care for British Columbians with a $74-million investment that funds new initiatives focused on prevention and early intervention for children, youth and young adults.

* Increasing support by an additional $30 million, for a total of $608 million since Budget 2017 Update, to help tackle B.C.’s drug overdose crisis. This will help expand access to life-saving naloxone kits and fund pilot programs to help meet increased demand for paramedics in rural and remote areas of B.C.

* Expanding B.C.’s Fair PharmaCare program with an additional $42 million, providing coverage for more drug options that will improve the health outcomes of British Columbians. That includes people living with diabetes, asthma and hypertension.

* Providing over $550 million in additional supports for B.C.’s public education system, including $58 million over three years for the Classroom Enhancement Fund to support better classrooms for kids. This is in addition to the over 4,000 new teachers, including 1,000 special education assistants, hired to support students in B.C. classrooms.

* Moving forward with an annual investment to pilot legal clinics to help people access the legal services they need.

* Adding $111 million over three years to continue strengthening the Province’s efforts to combat and prevent wildfires.

Investing in a strong, sustainable economy that works for people

* Making more than $20 billion in capital investments primarily in the health, transportation and education sectors-the largest infrastructure investment in B.C.’s history. This will create tens of thousands of jobs in communities around B.C.

* Providing over $902 million for CleanBC, putting B.C. on the path to a cleaner, brighter, low-carbon future. This will reduce air pollution and save families money through the Clean Energy Vehicle Program, incentives for energy-saving home improvements, a net-zero building code and programs to help communities transition to cleaner energy sources.

* Diversifying forest tenures and manufacturing, increasing timber processing in B.C. and supporting collaboration with stakeholders, including Indigenous governments with a $10-million investment.

* Investing $18 million to continue making Adult Basic Education and English Language Learning free and accessible for people looking to upgrade their skills and get ahead.

* Adding $21 million to expand BC Transit and handyDART services to help people safely commute in over 30 urban and rural communities in the province.

* Providing over $39 million in new funds over three years to ensure B.C.’s bridges and roads keep people and goods moving, and an additional $4 million to improve commercial-vehicle safety by increasing inspection station hours and targeted enforcement.

* Investing $9 million over three years to implement government’s commitment to modernize the taxi industry and enable ride-hailing in B.C. This includes funding for enhanced vehicle compliance and enforcement activities, and supports the new provincial regulator, the Passenger Transportation Board.

* Providing an additional $15 million for the BC Arts Council to open doors for B.C. artists, writers and creators.

* Making a historic $20-million investment to fund a fair, independent oversight body in the mining sector.

* Providing nearly $14 million over three years to transform B.C.’s employment standards for protections and enforcement, keeping people safe at work.

* To help connect communities and businesses, government is committing $50 million to expand high-speed internet in rural and remote communities throughout B.C.

For more details on Budget 2019, visit: www.bcbudget.ca