Wednesday September 4, 2024 | VICTORIA, BC [NATIONAL]

by Mary P Brooke | Island Social Trends

As was anticipated by economists and the business sector, the Bank of Canada has lowered their policy rate by a quarter basis point to 4.25%.

That’s the third rate reduction in 2024, previously also lowered on June 5 (from 5.0% to 4.75%) and on July 24 (from 4.75% to 4.5%).

Generally this is good news for households and businesses. Variable rate debt holders will feel the effects right away. Some consumer loan impacts will be seen if booking new; anything already with a fixed rate won’t see a rate change.

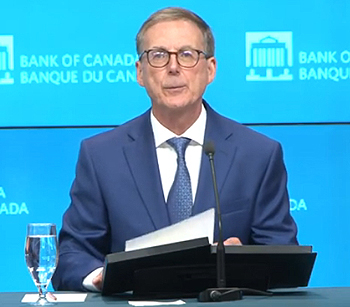

“Weakness in the economy is continuing to pull inflation down,” said Bank of Canada Governor Tiff Macklem today in his opening remarks. [Watch the September 4, 2024 Bank of Canada announcement livestream]

Shelter costs:

Macklem said that shleter pricing (mortgages and rent) are at 25% of the total ‘basket’ of items that consumers pay for. He says that is “still too high”.

However, for many Canadians there are many people paying over the traditional 30% threshold for mortgage/rent as a percentage of income — many in fact up to 50% or more.

Next two rate announcement dates:

There will be two more rate announcements in 2024, scheduled for October 23 and December 11.

Today Macklem said “it is reasonable” to expect “further cuts” in the policy interest rates if the economy continues to unfold toward the bank’s inflation target of between 2% and 3%.

“We will continue to take our monetary policy decisions one at a time,” said Macklem today.

He says the Bank wants to “guard against the risk” that the economy becomes too weak.

===== RELATED:

- Bank of Canada announces 8 interest rate dates for 2025 (August 6, 2024)

- Bank of Canada drops interest rate for 2nd time in 2024 (July 24, 2024)

- Eby continues to target Bank of Canada about interest rates (July 17, 2024)

- First Bank of Canada rate drop in four years (June 5, 2024)

- NEWS SECTIONS: BUSINESS & ECONOMY | HOUSING | CANADIAN FEDERAL ELECTION 2025