Wednesday September 6, 2023 | VICTORIA, BC

by Mary P Brooke, Editor | Island Social Trends | BUSINESS & ECONOMY SECTION

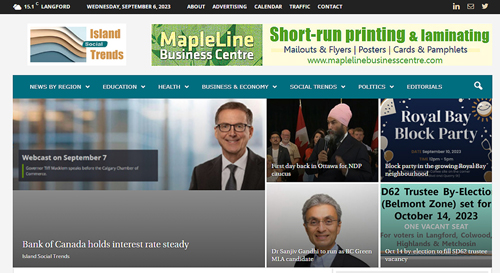

See article about Tiff Macklem’s speech Sept 7 to the Calgary Chamber of Commerce [link to come]

After 10 interest rate hikes by the Bank of Canada in the last 18 months, most Canadian households and small businesses feel the pressure has become to much. There is very little wiggle room — if any — in household budgets and business operational finances.

For those folks, the no increase to interest rates today by the Bank of Canada would be welcome news. The rate remains at 5%. The next rate announcement will come in October 25, and the bank reserves room to increase their central rate further, if required in their view.

The Bank of Canada uses one blunt tool … the raising or lowering of the central bank rate. Banks, mortgage lenders and other financial institutions follow suit — usually only with increases, not decreases.

“The Canadian economy has entered a period of weaker growth, which is needed to relieve price pressures,” said the Bank of Canada in their September 6, 2023 news release.

“Year-over-year and three-month measures of core inflation are now both running at about 3.5%, indicating there has been little recent downward momentum in underlying inflation. The longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability.” it was stated by the Bank of Canada today.

Macklem addresses Calgary Chamber of Commerce tomorrow:

The next bank rate decision was announced Wednesday September 6 at 10 am Eastern (7 am PDT), in a news release, without any webcast or media availability.

Tomorrow Bank of Canada Governor Tiff Macklem will take media questions the following day. That will follow his address to the Calgary Chamber of Commerce. The September 7 media availability webcast will take place at 12:10 pm Mountain Time (11:10 am PDT).

Psychological relief:

Much of the action to manage the rate of inflation is psychological. To give relief at this point may help the economy and the price of everything to settle into a more stable pattern. When businesses expect their interest-carrying costs to keep going up, they generally keep pushing up their prices. This lands hard on consumers — for items big and small once inflation gets into an upward spiral.

The impact of higher interest rates has made its way into just about everything in the economy — but most notably affecting the cost of housing, groceries, and insurance. Most people’s income does not keep rising and find it hard to keep up. There are only so many areas of so-called ‘disposable income’ to cut back on.

Post-pandemic economy is not the same:

The primary levers that the Bank of Canada looks at — such as GDP, unemployment rate, etc. — are old-fashioned measures that no longer apply in a post-pandemic economy.

There can no longer be an assumption that consumers can weather the storm of increasing prices on nearly everything.

Many people in this decade are already maxed out due to the high cost of living and not only stagnant wages but a limited range of ways to increase one’s income (gig economy, second job, etc. can only go so far).

Many people who suffered economically during the pandemic don’t have savings or the same sort of financial resilience that they would have had pre-pandemic. And many people in 2017 to 2019 were really only fully recovered from the 2008 Great Recessions which gouged all but the well-financed for years as they caught up.

Premiers spoke up:

BC Premier David Eby wrote a letter to the Bank of Canada last week asking for no further interest rate increases by the central bank. Yesterday Ontario Premier Doug Ford followed suit, and the Premier of Newfoundland and Labrador Andrew Furey also chimed in.

“I share the views of my colleague, Premier David Eby of British Columbia, that many families and businesses are struggling to make ends meet and cannot afford the crushing impact of any further rate hikes,” said Premier Ford.

“This is not an academic debate – increased rates hurt many people in our province,” said BC Premier Eby in a social media post after posting a copy of his letter that he sent to the Bank of Canada. “It’s not just homeowners. Renters, young people, seniors, families, small businesses, with car payments & lines of credit, are getting squeezed. Mortgage rates are already the biggest contributor to inflation. If pushed higher, it will be devastating for building new homes,” said Eby.

“People in B.C. are already hurting,” said Eby in his letter. “In your role as governor, I urge you to consider the full human impact of rate increases and not further increase rates at this time.”

Eby also wrote to the prime minister to urge him “to work with us to tackle the root causes of inflation”. Eby defined that as “building more homes for people, strengthening supply chains, and make it easier and cheaper to move goods.”

Federal NDP comment:

Federal NDP Leader Jagmeet Singh said last week in a national news conference from Sooke that the Bank of Canada mechanism of increasing interest rates is having negative impacts on people and small businesses living with the consequences of higher interest rates.

He delicately suggested that just doing something that sounds good in theory — without taking into account real impacts — was an error in judgement on the Bank’s part.

===== RELATED:

Next Bank of Canada rate decision Sept 6 (September 4, 2023)

Jagmeet visits Sooke to talk about cost of living (August 31, 2023)

Premier Eby on July 12 Bank of Canada rate increase (July 12, 2023)

10th Bank of Canada rate increase in 16 months (July 12, 2023)

Eby: Interest rate hikes impacting people who can least afford it (July 11, 2023)

Bank of Canada Deputy Governor draws a crowd in Victoria (June 8, 2023)