Wednesday October 29, 2025 | NATIONAL – reporting from VICTORIA, BC [Posted at 11:22 am PT | Updated 11:50 am PT]

Preview analysis by Mary P Brooke, Editor | Island Social Trends

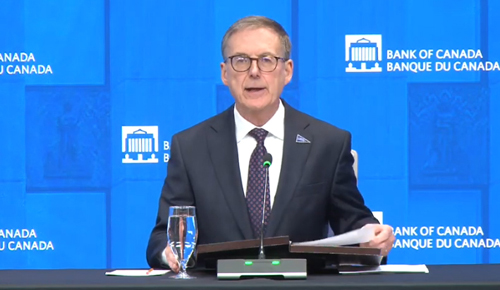

Today the Bank of Canada delivered their scheduled interest rate announcement which sees their policy interest rate now dropped by 25 basis points to 2.25%.

This year started with an interest rate of 3.25% (from the December 11, 2024 rate announcement), and has seen now four rate drops of 25 basis points each (to 3.0% on January 29, to 2.75% on March 12, to 2.5% on September 17, and now to 2.25% on October 29).

One more interest rate announcements remains in 2025:

- Wednesday, January 29

- Wednesday, March 12

- Wednesday, April 16

- Wednesday, June 4

- Wednesday, July 30

- Wednesday, September 17

- Wednesday, October 29

- Wednesday, December 10

As they did during the spring and summer of this year, the Bank of Canada could have held steady without a change in the interest rate.

But dropping the rate again indicates — at least in part — that the economy needs a boost in confidence if not actual fiscal advantage during a time of structural transition.

The economic transition now underway in Canada was kickstarted by the US Administration’s economic trade war against Canada. This country is now on a long future-forward path to trade diversification in an effort to reduce reliance on exports to the United States.

While the US will always be Canada’s biggest customer due to geographical proximity and a somewhat similar culture, this is a maturation phase for Canada to spread its wings and find stability in trade with more markets. Prime Minister Mark Carney got elected on promising to do just that; he’s been quick to shift to a European trade focus and this week has been in south Asian countries to build up trade relations with Singapore, Malayasia, Vietnam and other nations in that region.

Helping for the longer term:

Rate drops in the current economic conditions don’t help many households in the short-term that are struggling with consumer debt (credit card companies rarely respond to central bank rate reductions with a drop in their rates).

Consumption growth is expected to slow, said Macklem. People seem to be dipping into their savings, said Rogers.

Macklem says that the standard of living is likely now to be lower.

Where people are ready to renew a fixed-rate mortgage that was taken out three, four or five years ago, the lower rate may help (though balanced against the likely disadvantage of higher housing prices than a few years ago).

For larger business investment today’s rate drop (on the heels of three others this year, may finally feel like it’s a safer time to make bigger plans for major project investment.

Four main messages:

The Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers had four main messages in their October 29, 2025 announcement | Also seer the October 29, 2025 Bank of Canada rate announcement webcast.

- US tariffs and trade uncertainty have weakened the Canadian economy. We expect very modest growth through the rest of the year, with some pickup in 2026.

- While this weakness is restraining price increases, the trade conflict is also adding costs for many businesses, putting upward pressure on inflation. We expect these opposing forces to roughly offset, keeping inflation close to the 2% target.

- To support the economy through this period of adjustment, we have lowered our policy rate by 50 basis points over our last two meetings and by 100 basis points since the start of the year.

- The weakness we’re seeing in the Canadian economy is more than a cyclical downturn. It is also a structural transition. The US trade conflict has diminished Canada’s economic prospects. The structural damage caused by tariffs is reducing our productive capacity and adding costs. This limits the ability of monetary policy to boost demand while maintaining low inflation.

One blunt tool:

The central bank has only one blunt tool — the adjustment of interest rates. Factors usually taken into consideration for interest rate adjustments include unemployment levels, the current rate (and trend) of the Consumer Price Index (CPI), and the rate of inflation.

Since the pandemic (in 2020 and 2021 when interest rates were nearly zero) there has been an increasing tendency for the Bank to go deeper into considering data about household and consumer impacts, small business performance, and productivity.

The Bank aims to keep inflation around 2.%.

“The US has swerved to protectionist,” said Macklem.

“We need to be humble about our forecasts,” said Macklem today, and be prepared to respond to changes, he added.

Monetary policy cannot restore Canada’s economy to its previous path, Macklem said.

Factors of uncertainty:

Factors of uncertainty as explored during summer rate announcements, and now more clear.

“While the global economy has been resilient to the rise in US tariffs and increased uncertainty, the impacts are becoming more evident. Trade relationships are being reconfigured and uncertainty is dampening investment in many countries,” said Macklem in his statement today.

- “In Canada, the impacts of US trade policy are already clearly apparent.”

- “GDP contracted 1.6% in the second quarter as tariffs and uncertainty reduced exports and business investment. US trade actions are having severe effects on targeted sectors including autos, steel, aluminum and lumber. Household spending was resilient in the second quarter, with strong consumer spending and a pickup in residential investment.”

- “The labour market is soft. Employment gains in September followed two months of sizeable losses. Job losses have been concentrated in trade-sensitive sectors and hiring has been weak across the economy. The unemployment rate remained at 7.1% in September, and wage growth has slowed.”

- “In the second half of this year, GDP growth is expected to resume, but remain weak, averaging about ¾%. It should then pick up on a quarterly basis in 2026 as exports and investment recover, and average about 1½% by 2027. This implies excess supply is only taken up gradually.”

- “Even as growth recovers, the entire path for GDP is lower than it was before the shift in US trade policy. By the end of 2026, the level of GDP is about 1½% lower than forecast in January. About half of this downward revision reflects lost capacity as a result of the trade disruption. The other half is due to weaker demand.”

- “CPI inflation was 2.4% in September, slightly higher than the Bank had anticipated. The Bank’s preferred measures of core inflation have been sticky around 3% but upward momentum has dissipated. Looking at a broader range of indicators, underlying inflation looks to be around 2½%. The Bank expects inflationary pressures to ease in the months ahead and CPI inflation to remain near 2% over the projection horizon.”

Interest rate announcement dates in 2026:

The Bank of Canada has published their interest rate announcement dates for 2026 as January 28, March 18, April 29, June 10, July 15, September 2, October 28, and December 9.

===== RELATED:

- Bank of Canada interest rate decisions: When in doubt, do nothing? (October 28, 2025)

- Bank of Canada interest rate drop to 2.5% on Sept 17 (September 17, 2025)

- NEWS SECTIONS: BANK OF CANADA | 45th PARLIAMENT of CANADA | BUSINESS & ECONOMY | EDITORIALS