Housing crisis requires political will and thoughtful action

Friday, September 28, 2018 ~ West Shore & BC

Housing analysis by Mary P Brooke, West Shore Voice News

======================================

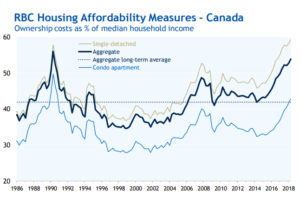

RBC Economics Research has just released their latest quarterly Housing Affordability study pinpointing cross-country trends in housing affordability in provincial and major metropolitan housing markets.

Their conclusion about housing ‘unaffordability’ should come as a surprise to no one.

“Unaffordability is off the charts in Vancouver, Toronto and now Victoria,” says the September 2018 report from the major bank. RBC says the affordability measure hasn’t been this bad since 1990. The ownership costs to carry a home bought in the second quarter of 2018 would have taken up 53.9% of a typical household’s income. This is up sharply from 43.2% three years ago.

Banks have traditionally required a 30% cap on home ownership costs as a percentage of household income. Spending more than 30% on home ownership (or rent for that matter) has long been situation in the Greater Victoria area for many people. The burden of that is only now reaching awareness in the mainstream because even families with two incomes can’t often qualify for a mortgage.

Mortgage rates have increased in each of the past four quarters says RBC, and claims to “blame interest rates for the rise in ownership costs in the past year”. “Interest rates have a big impact in these high-priced markets,” says RBC. “The situation is much less strained in other markets, although affordability deteriorated in all markets in Canada in the past year.”

This 2018 peak in housing unaffordability comes on the heels of a steadily heating market (particularly in BC) in the last 30 years.

One measure by the federal government to ‘cool the market’ is the mortgage stress test (i.e. anyone getting, renewing or refinancing a mortgage qualify needs to qualify at a rate that is higher than current rates) that came into effect January 1, 2018.

News last summer/fall 2017 about the pending stress test spooked buyers and banks, even then starting to ‘cool the market’. The Bank of Canada admitted before January that the stress test would likely shut out 10% of low-ratio homebuyers.

First time-buyers are intensely squeezed out of the market. They often end up in the higher-end of the glutted rental market where they essentially take up room that the regular renter market needs and also diminishes their ability to save up to put a downpayment on a home. This is an socioeconomic sector that still is motivated to try hard … they’ve often got new businesses or young families, they’ve potentially got stars in their eyes for a full and successful life ahead of them. Squeezing this group makes no socioeconomic sense. It can crush people, serving to diminish their enthusiasm on all sorts of levels. A smart economy seeks the verve of the ‘up and coming’. Suppressing young families and talent within the workforce — by diminishing their basic housing security — is starkly counter-productive to a healthy society and economy.

The stress test (officially released October 17, 2017 from the Office of the Superintendent of Financial Institutions Canada – OSFI) means that financial institutions must vet a mortgage application by using a minimum qualifying rate for uninsured mortgages to be equal to the greater of the Bank of Canada’s five-year benchmark rate (currently 5.34%) or their contractual rate plus two percentage points. Federally regulated financial institutions must also “adhere to appropriate loan-to-value (LTV) measurement and limits so they will be dynamic and responsive to risk”. The banks are taking no chances.

RBC’s conclusion in their September 2018 report? “It’ll probably get worse. We expect further interest rate hikes in the period ahead. This is poised to drive ownership costs even higher across Canada. Household income increases will soften the blow for buyers.”

The Victoria Real Estate Board statistics for August 2018 show the single family home average sale price as $937,459 for the overall Greater Victoria region. In the west shore, average sale prices in August were somewhat lower than a few months previous (indicating that ‘market cooling’): Langford: $708,970 (had been as high as the $772,000 range earlier this year) | Colwood: $727,447 | Sooke: $446,065 (had been well over half-a-million at points earlier this year).

This crushing reality in the housing market is coupled with regularly increasing rental rates (it was 4.0% in BC for this year, but is being held to inflation at 2.5% for 2019).

For many individuals and families now, it’s put a roof over your head and then see what’s left for everything else. It sets up an underlying tone of desperation. Depending on life circumstances (sometimes unforeseen), homelessness could easily lurk in the shadows for anyone. This puts pressures on people and their families who may need to make creative lifestyle choices, presents challenges to businesses who can struggle to find employees who can afford nearby accommodation, puts a chill on investors who normally fuel economic expansion, and now overloads government coffers with an upward demand on the safety-net measures that are in place (e.g. rent subsidies). In turn there is pressure on food banks.

The present scenario is hopefully a loud wake-up call that continued attention to the housing crisis should be the primary concern for all levels of government, particularly provincial (as housing falls directly under their watch). Fixing the housing crisis is not just about relying on traditional market forces and tinkering with economic drivers. Increasing the supply homes is an obvious need (30-point plan of the BC government is rolling out, but the construction and development industries have their challenges in a stressed economy and the poorly executed introduction of the proposed BC Speculation Tax has released poison into the very important relationship between the development community and government).

The most important factor is about establishing a steadfast political will and then taking action on it. Every politician should now be asked for their position on housing, including all municipal candidates in BC ahead of the October 20 election.

::: GRAPHIC. RBC Economics: Ownership cost as a percentage of median household income (1986 to 2018)

Back to the Editorials page | Back to the main page