Wednesday January 28, 2026 | NATIONAL NEWS [Reporting from VICTORIA, BC | Posted at 7:10 am | Updated 7:37, 7:54 am & 8:12 am PT]

Analysis by Mary P Brooke | Island Social Trends

Watch the Jan 28, 2026 Monetary Policy Report & Interest Rate Announcement [webcast]

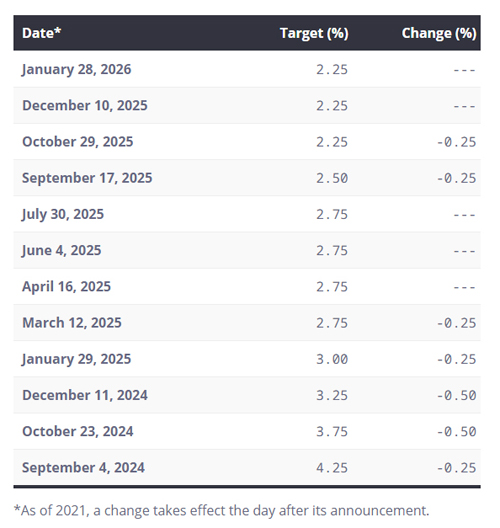

In their first interest rate announcement of 2026, the Bank of Canada has held their policy interest rate at 2.25%.

The rate was first lowered to 2.25% on October 29, 2025 (from the previous 2.5%) and held at 2.25% on December 10, 2025.

Today’s rate announcement is the first of 2026, with seven more to come this year on March 18, April 29, June 10, July 15, September 2, October 28, and December 9.

Held as expected:

As previously stated by Island Social Trends on January 25, most economists and watchers of things economic expected no change in the interest rate in today’s announcement due to continued uncertainty in the trade situation with the United States and the diversification process that Canada’s various levels of government and many industrial sectors are undertaking.

Indeed that has been the case: “The outlook for the global and Canadian economies is little changed relative to the projection in the October Monetary Policy Report (MPR). However, the outlook is vulnerable to unpredictable US trade policies and geopolitical risks,” said the Bank of Canada in their rate announcement today.

“If the outlook changes we’re prepared to respond,” says Bank of Canada Governor Tiff Macklem today. [See more comments, below]

Economic growth:

“Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism,” the Bank of Canada says today.

In the bank’s projection today, consumer spending holds up and business investment strengthens gradually, with fiscal policy providing some support.

“The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement,” it was stated in the January 28, 2026 rate announcement.

Bank of Governor’s comments:

Bank of Canada Governor Tiff Macklem and Deputy Governor Carolyn Rogers addressed media at 10:30 am ET (7:30 am PT) today. Key notes:

- Reallocation of workers can be expected as new opportunities open up.

- Impacts of uncertainty will gradually reduce over time.

- There are a number of outcomes from the upcoming CUSMA negotiations.

- “We’ll be better of if we adjust than if we don’t,” said Governor Tiff Macklem regarding how the Canadian economy adjusts to impacts of the US tariffs.

- “This is a big year for mortgage holders in terms of the number of mortgages that are rolling over,” says Deputy Governor Carolyn Rogers.

- “The reason something is a risk is because you haven’t thought of it,” said Deputy Governor Carolyn Rogers, in the context of what else may happen in response to any further economic uncertainties.

- “A strong (US) fed benefits any economy in the world,” says Rogers, saying it would benefit Canada the most.

Keeping inflation around 2%:

Monetary policy is focused on keeping inflation close to the 2% target while helping the economy through this period of structural adjustment.

Driving factors:

“Economic growth in the United States continues to outpace expectations and is projected to remain solid, driven by AI-related investment and consumer spending,” says the Bank of Canada today.

“Tariffs are pushing up US inflation, although their effect is expected to fade gradually later this year,” says the Bank of Canada about the world’s largest economy to the south of Canada.

The Bank’s overview:

- US trade restrictions and uncertainty continue to disrupt growth in Canada.

- After a strong third quarter, GDP growth in the fourth quarter likely stalled.

- Exports continue to be buffeted by US tariffs, while domestic demand appears to be picking up.

- Employment has risen in recent months. Still, the unemployment rate remains elevated at 6.8% and relatively few businesses say they plan to hire more workers.

===== RELATED:

- Bank of Canada interest rate expected to remain at 2.25% on Jan 28 (January 26, 2026)

- NEWS SECTIONS: BANK OF CANADA | AFFORDABILTY | BANKING & FINANCE| TRADE DIVERSIFICATION