Monday December 22, 2025 | VICTORIA, BC [Posted at 2:49 pm]

Socioeconomic analysis by Mary P Brooke | Island Social Trends

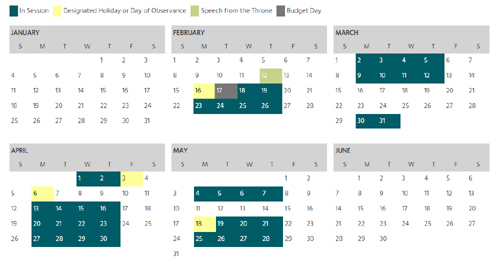

BC Budget 2026 will be delivered on Tuesday February 17.

That comes after the Throne Speech on Thursday February 12 (followed by the BC Family Day long weekend).

The full parliamentary session starts Wednesday February 18 (through to May 28).

Budget speaks volumes:

A provincial budget is a political stance on things for the economy and all things that are impacted throughout the province.

Over the past year, Finance Minister Brenda Bailey has not wavered on her message that BC will put people first and support those who need it.

Bailey has indicated in both her 2025 First Quarterly (September) and Second Quarterly (November) reports and in her speech to the Union of BC Municipalities (in September 2025) that the BC NDP government will continue to invest in infrastructure that supports communities and families, notably hospitals and schools.

Economic forecast recommendations:

On December 8, Minister Bailey received economic input from a range of economists from Canada’s main banks, some credit unions, and agencies.

During that annual Economic Forecast Council meeting (held remotely), BC’s finance minister heard some recommendations for things that BC is already doing (e.g. investing in skills trades training in order to support economic growth, and investing in technological innovation) as well as things that BC has done in the past but caused economic and market problems (e.g. foreign investment in real estate).

She heard a common message across the day’s participants that productivity must be boosted (a problem that the economic has been challenged with nation-wide since the year 2000). She was encouraged to position BC aggressively in the economy in 2026.

All the economists agreed that mining and critical minerals as well as the major LNG projects in BC will be a strong underpinning for BC in the next few year and beyond.

Push from the BC Conservatives:

The Opposition BC Conservatives feel the debt and deficit in Budget 2025 have been too high.

Opposition Finance Critic Peter Milobar feels that innovation should be in forestry and other sectors that support economic growth in the north, in addition to the NDP’s investment in the lower Mainland digital tech, bio sciences, and film sectors.

The BC Conservative economic stance seems aligned with the economists who indirectly suggested that BC spends too much on shoring up protections, but but should instead be more aggressive with investment and income tax breaks for higher-level earners.

That’s where the BC NDP approach to governing for the people will be challenged. The traditional economic approach to investing in business relies on a ‘trickle down’ effect (i.e. if businesses make more money then workers and communities will benefit) – but that philosophy has not borne evidence of success since an intention for that approach starting in the 1980s.

Milobar says the BC Conservatives do not dispute the need for job training and investments in health-care and education.

Dealing with uncertainties:

Economic uncertainties in BC (and across Canada) due to the trade disruption caused by the United States has put unique pressures on all provincial budgets. That’s a common thread for the federal and provincial governments heading into 2026.

In crisis there is opportunity. The tariff pressures have forced some specific sectors to be impacted (e.g. steel, aluminum, lumber, auto-assembly) and provides an opportunity for the Canadian government to provide leadership in redirecting the work force into digital tech (AI is emerging fast) and new service industry delivery (including a shift of workers from Canada Post into other areas as the business model of that crown corporation changes).

BC Budget 2026 predictions:

The BC NDP government is likely to aim to maintain underlying social supports while continuing their strategy for investment in people and infrastructure.

Job training investments are likely to be ramped up (including new seats at health-care schools and trade-training centres) and new community infrastructure projects are likely to be announced (such as health care facilities or additions, and more schools).

This month there was BC/federal collaboration on job strategies as BC Minister of Jobs and Economic Growth Ravi Kahlon spent a day with key ministers and BC MPs in Ottawa.

There have already been some BC public service job cutbacks (over 1,000 fewer people working in government jobs compared to last year) and a continual review of expenditures (e.g. travel) and program effectiveness (results reviews).

Businesses that are active or jumping into new emerging sectors (e.g. tech, life sciences) are likely to see the most funding.

BC still has a good enough credit rating for that to not be a deterrent to borrowing what is needed to fulfill baseline economic obligations like support for renters and people with disabilities.

===== RELATED:

- BC economic resilience despite global trade volatility, retail sales softening (November 27, 2025)

- Preparing BC Budget 2026 with input from municipalities and economists (September 29, 2025)

- BC shows $665 million deficit increase in first quarter 2025 (September 15, 2025)

- NEWS SECTIONS: ECONOMY | BUDGET 2026 |