Tuesday November 4, 2025 | NATIONAL [reporting from VICTORIA, BC | Posted at 4:16 pm PT]

by Mary P Brooke | Island Social Trends | Also see:

- Jobs Minister Hajdu on Canada Post, Air Canada, youth employment, retraining supports (November 2, 2025)

- Carney’s sobering pre-budget speech delivered to university students (October 22, 2025)

- NEWS SECTIONS: CANADA-NATIONAL | BUDGET 2025 | 45th PARLIAMENT OF BC

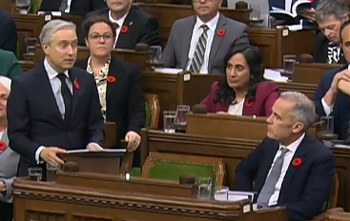

Today the first Carney Liberal government budget was tabled in the House of Commons.

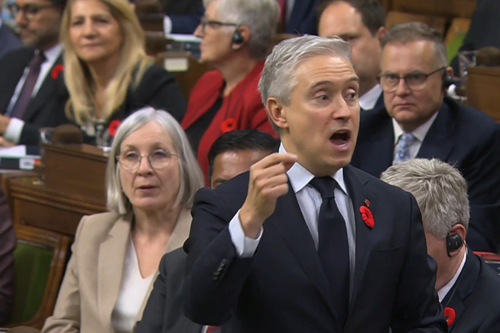

he budget speech by Finance Minister François-Philippe Champagne to deliver Budget 2025 was over an hour long, outlining the core details of the Budget 2025 document as presented. This was Champagne’s day, with Prime Minister Mark Carney looking on.

The covers of both main Budget 2025 documents feature a ship in the Arctic — emphasizing exports and the importance of strengthening the North for commerce and defence. Two documents (PDF): Canada Strong – Budget 2025 | Our Plan – Canada Strong

$6 billion is being set aside to build up Canada’s defence sector (including for capacity to manufacture of munitions in Canada for sovereignty security reasons).

The 1.5% of GDP that is required to meet the NATO defence spending target can include things like wildfire management (which is already expended by government).

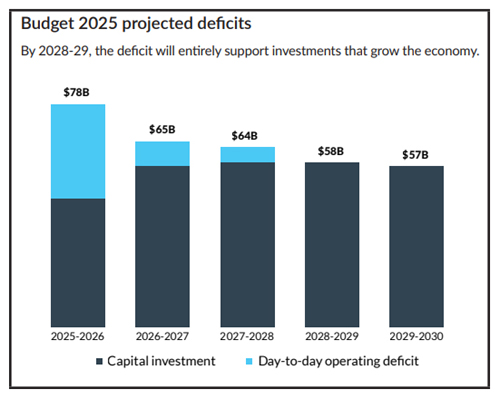

Deficit:

The projected deficit in Budget 2025 is $78.3 billion for this fiscal year.

The industrial carbon price is being strengthened which will help on the revenue side. Carney’s Major Projects are intended to eventually increase revenues for the country.

Key areas of investment:

The government’s 2025 budget sets out an agenda of $141.4 billion in new spending over the next five years. That will be offset by $51.7 billion in projected savings over the same period. The deficit is projected at $78.3 billion this year.

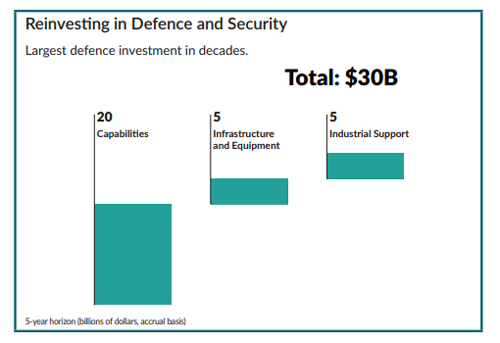

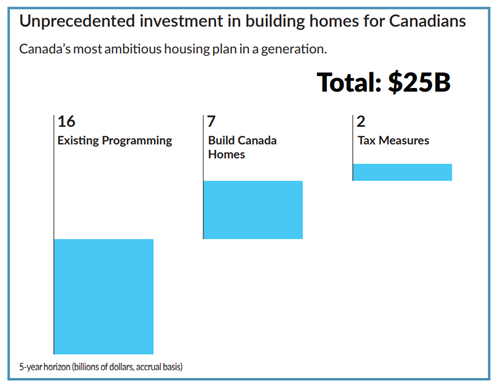

The budget outlines $115 billion in infrastructure spending over five years, $30 billion more in defence and security spending and $25 billion for federal housing initiatives over that same period.

It also promises to invest $110 billion over five years in what it calls productivity and competitiveness initiatives; the government hopes this will help their new target of “catalyzing” $500 billion in private sector investment by 2030.

Challenges:

Roadblocks or stumbling blocks to success with these ambitions include:

- Finding or encouraging enough private sector investment

- Having enough skilled workers in the labour force.

- The economy is near to being in recession.

- The trade war attacks from the United States continue.

- Inter-provincial trade is not flowing as smoothly as had been hoped.

- Trade diversification to countries other than the US is underway but will take time.

- Rolling out more initiatives while having already cut back on the public service.

Fall delivery in future:

Starting with Budget 2025, the government’s federal budget will now be delivered in the fall (instead of the spring), followed by an economic and fiscal update in the spring as the new fiscal year begins. This is to help other levels of government (provincial and municipal) plan more effectively and to line up with investment timelines for the construction sector.

Quick preliminary affordability analysis:

This budget delivery did not mention several key areas that people deal with every day.

- The cost of food or issues of food security was not mentioned. There were no specific measures to deal with immediate household affordability like the cost of carrying consumer debt that people use just to stay afloat, or the fees for things like wireless services.

- There was no mention of renting or renters.

- There was no mention of the ongoing drug crisis, which in many cases is related to people who are desperate due to unaffordability.

- There was no mention of health-care challenges like having enough doctors, or shifting to preventive health care to help with health-care sector savings in the long run.

- There was no mention of funding to post-secondary or tuition supports for students.

- There was no mention of supports for seniors or the disability demographic.

That’s not to say some of these things are not already happening within current programs and supports, but not mentioning them in the budget delivery is notable — the budget influence is almost entirely about transforming the economy.

Voting on the budget:

After budget debate for a few days, a vote will be held on the budget. Budget votes are confidence votes.

There are 343 MPs in the House of Commons. The Liberals will need 172 votes to see the budget pass. In addition to their own 169, they were going to need three more votes. But now one Conservative MP has crossed the floor, so now the Liberals need just two votes from opposition parties.

Where will those two come from? Probably only the NDP MPs can save the Liberal government on this confidence vote (or one vote from NDP and one from Green). Here’s the breakdown:

- The Conservatives (144 seats, down to 143 today when Conservative MP Chris d’Entremont (Acadie-Annapolis) announced that he has crossed the floor to the Liberals). Conservative Leader Pierre Poilievre confirmed in the House of Commons today that his party will not be supporting the budget.

- The Bloc Québécois has 22 seats. Bloc Leader Yves-François Blanchet said they don’t see any of their desired budget items in Budget 2025, and the party will probably vote no. “I think the chances we’re going to support the budget are next to zero,” said Bloc Québécois Finance Critic Jean-Denis Garon today on CBC, emphasizing that the Bloc caucus will decide collectively on the Bloc position.

- The NDP has seven MPs. In previous weeks NDP Leader Don Davies has said the NDP won’t support an ‘austerity’ budget. He told media that the party will be reviewing the budget over the coming days.

- Green Party Leader Elizabeth May says she currently doesn’t support the budget but told media today that amendments over the coming days can happen (which presumably might change her position).

Budget 2025 content:

Here are some key basics as presented in the budget today:

Canadian Advantage:

Despite challenges, Canada remains strong and has what the world wants:

- Talent: a skilled, educated, and adaptable workforce.

- Resources: critical minerals, clean and conventional energy, and agri-food.

- Market access: the only country in the G7 to have free-trade agreements with all

the other G7 countries. - Resilience: a strong social safety net and stable institutions.

- Rule of law: a robust and reliable financial system, an independent judiciary, and

transparent governments. - Investment attractiveness: a favourable environment for foreign investments that grows

our economy and creates high-paying careers. - Tax competitiveness: lowest overall tax burden in the G7 on new business investment.

Investments:

We are strengthening the economic foundations of our nation, giving our workers, innovators, and businesses the tools they need to compete, create, and lead in a changing world.

- Fast-tracking nation-building projects: In close partnership with provinces, territories, Indigenous Peoples, and private investors the government is streamlining regulatory approvals and helping to structure financing.

- Competing and winning abroad: To seize new opportunities in a changing world, Canada is launching a new Trade Diversification Strategy to boost our global footprint. Building on our world-class agreements and partnerships, this strategy will double overseas exports over a decade, generating $300 billion more in trade. Through a new Trade Diversification Corridors Fund, we will improve access to overseas markets by investing in new port, airport, and railway infrastructure. And we are providing Canadian businesses with the tools and expertise they need to succeed abroad. Canada will be a fast, reliable, and indispensable global partner.

- Becoming our own best customer: Our new Buy Canadian Policy will ensure public dollars will be used to strengthen our supply chains, and support homegrown innovation. When the government spends, we will select Canadian suppliers by default, wherever possible. By launching our Defence Industrial Strategy, we will grow our defence sector, increasing the capacity and competitiveness of homegrown defence suppliers.

- Investing in defence and security: Our government is making a generational investment in defence that will create good, high-paying careers for Canadians, and strengthen our economy and collective resilience.

- Driving growth and innovation: Our government will make it cheaper for Canadian companies to invest through a new productivity super-deduction. We will invest in AI projects to further the technology’s adoption at home, and catalyse private sector investment in Canada’s most innovative startups. The government is also developing a new AI strategy, and will consider whether new AI incentives and supports should be provided. We are creating the right conditions for real, sustainable growth.

- Powering a clean economy: Through Canada’s new Climate Competitiveness Strategy, we are strengthening Canadian leadership in a low-carbon economy. With the Clean Economy Investment Tax Credits, we will supercharge affordable, net-zero energy projects that turn our natural wealth into lasting prosperity while protecting the planet. Canada will build for the future, leveraging nuclear, solar, wind, clean hydrogen, and other renewable energy.

- Protecting our strength: A Strategic Response Fund to realign producers to serve the Canadian market and reach new markets globally, coupled with a major reskilling effort, will help tens of thousands of workers and key sectors—from canola to lumber to steel and aluminum and our auto sector—stay competitive and resilient in a shifting global economy.

Dealing with the housing crisis:

Canada is facing a steep housing supply gap. One that threatens affordability, opportunity, and the ability for Canadians to build a life and a future here at home.

The Canada Mortgage and Housing Corporation estimates that to restore affordability to 2019 levels, homebuilding must nearly double from its current pace of around 280,000 homes per year to between 430,000 and 480,000 homes per year over the next decade. The Parliamentary Budget Officer estimates 290,000 homes per year would be needed to close the supply gap.

Canadians demand immediate action, and this government is delivering with the urgency that this moment requires—with bold action to unlock supply and bring affordability back within reach. From eliminating the GST for first-time buyers on homes at or under $1 million, to launching

Build Canada Homes—a new federal agency that will drive investment and public-private cooperation—we will build faster and smarter.

Federal dollars invested in Build Canada Homes will be leveraged to attract private capital, investors, and builders to expand the housing supply. We are putting the conditions in place to catalyse maximum investment while mainstreaming advanced methods of construction, with the potential to cut building timelines by up to 50 per cent, reduce costs by as much as 20 per cent, and lower emissions by approximately 20 per cent during construction. With this, Canada can significantly increase its supply of affordable homes and become a global leader in housing innovation, including in construction techniques, sustainable materials, and leading-edge manufacturing.

Bringing down costs for Canadians:

“Budget 2025 will spend less on government operations and cut waste, so we can invest more in growing our economy and protecting essential programs that make life more affordable. Our new government has been focused on bringing down costs and creating new opportunities for Canadians. We have:

- Cancelled the divisive consumer carbon price, cutting gas prices by approximately 18¢ per litre in most provinces and territories.

- Cut taxes for 22 million middle-class Canadians, saving a two-income family up to $840 per year.

- Created opportunities for young Canadians to transition into the workforce and launch successful careers, by launching a Youth Climate Corps, and providing 175,000 placements through Canada Summer Jobs, the horizontal Youth Employment and Skills Strategy, and the Student Work Placement Program in 2026-27.

- Made the National School Food Program permanent to provide meals to up to 400,000 children every year, allowing participating families with two children to save an average of $800 per year.

- Begun the process to launch Automatic Federal Benefits that will reach up to 5.5 million low-income Canadians for the 2028 tax year to ensure everyone who deserves benefits receives them.

- Renewed the Canada Strong Pass, helping families and young people travel and explore Canada for less.

- Reduced Confederation Bridge and interprovincial ferry fares in Atlantic Canada— leading to a 25 per cent increase in usage of these services for visitors leaving Prince Edward Island in August, compared with the previous year.

- Upheld the Canadian Radio-television and Telecommunications Commission decision to expand wholesale access, boosting competition and lowering Internet costs for Canadians.

- A more affordable Canada also means a more competitive one. Budget 2025 will include early, but meaningful, measures to increase competition and drive down costs in key sectors such as telecommunications and banking. Our government will continue to push for more choice for Canadians across the economy. Our government remains focused on empowering Canadians—by lowering costs, expanding opportunity, and protecting the vital social programs Canadians rely on, from child care to dental care to pharmacare.”

===== RELATED:

- Jobs Minister Hajdu on Canada Post, Air Canada, youth employment, retraining supports (November 2, 2025)

- Carney’s sobering pre-budget speech delivered to university students (October 22, 2025)

- NEWS SECTIONS: CANADA-NATIONAL | BUDGET 2025 | 45th PARLIAMENT OF BC