Thursday July 11, 2024 | VICTORIA, BC

Sociopolitical analysis by Mary P Brooke | Island Social Trends

BC provincial budget issues aren’t the usual fare of the summer season.

But this week the Fraser Institute came out with a missive that the BC government should “should stop relying on volatile boom-and-bust resource revenues—like the Alberta government—and fundamentally change its fiscal approach”.

Their report recommends a traditional approach to finance, as in “establishing a fiscal framework to control expenditures to return to a balanced budget and begin saving”. And further in traditional accounting lingo: “In the longer term, the implementation of the fiscal framework would create a range of policy options including tax relief, and explicit debt reduction.”

Further, the province “has also not had a clearly defined framework with respect to managing the deficit or debt burden”, the report says.

More specifically, the attack was on the use of natural gas revenues. in a Fraser Institute news release on July 9 about a new study.

The Fraser Institute was drawing a straight line between the province’s natural gas revenues and the government’s deepened spending on social programs, in a report called A New Fiscal Framework for British Columbia as put forward by Fraser Institute Senior Fellow Ben Eisen and Joel Emes.

“Clearly, the B.C. government should stop using onetime natural gas revenue to finance ongoing government programs,” said Ben Eisen, senior fellow at the Fraser Institute and co-author of A New Fiscal Framework for British Columbia.

But the Ministry of Finance said in a statement to Island Social Trends today that “as with other revenue sources, all natural gas revenues go into the general revenues and support government’s budget and fiscal plan. Major programs in the budget and fiscal plan include health care, education, housing and public safety”.

The Fraser Institute says that the B.C. government’s natural gas revenues are the province’s primary source of resource revenue, but the Finance Ministry says that “British Columbia has a diversified economy and does not rely on natural resource revenue to fund program spending to the same extent as other jurisdictions”.

Insisting that natural gas revenues are financing ongoing programs, the Fraser Institute says there is “a mismatch between the nature of the revenue (onetime resource revenue) and the nature of spending”.

By the numbers:

The Fraser Institute says that the B.C. government’s natural gas revenues were an estimated $2.3 billion in 2022/23 and are projected to total more than $3.3 billion between 2024/25 and 2026/27.

But there is government prudence. “The Province forecasts that the 2024/25 natural gas price are within the 20th percentile of the private sector forecasts, providing a measure of prudence in the forecast in response to price and volume volatility,” says the Finance Ministry in their statement to Island Social Trends today.

“Natural gas royalties are expected to increase over the three-year fiscal plan period due to higher royalties on natural gas as well as increased production volumes,” says a spokesperson for the Finance Ministry.

Calling for restraint:

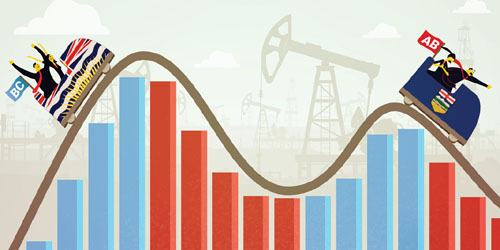

“If B.C. adopted this fiscal framework, it would stop relying on the same type of boom-and-bust resource revenue that’s made the fiscal situation in Alberta so volatile,” says the Fraser Institute.

“For years, Albertans rode the resource revenue roller-coaster and saw their fiscal situation rapidly deteriorate—the B.C. government should get off that roller-coaster,” Eisen said.

About the Fraser Institute:

The Fraser Institute describes themselves an independent, non-partisan Canadian public policy think-tank.

However most of their findings and published statements usually fall right of center on the political spectrum. In fact, this week’s report, The Fraser Institute says that the BC government “transformed its approach to the management of public expenditures” when the NDP came to power in 2017.

Notably, the Fraser Institute has over the last two decades or so been highly critical and narrow in their interpretation of BC education student assessment results, in ways that have made things challenging for school districts.

About the Finance Minister:

First elected as an NDP MLA in 2005 (reelected in 2009, 2013, 2017, 2020), Finance Minister Katrine Conroy is not seeking re-election in the fall 2024 provincial election.

Conroy has served as Finance Minister under Premier David Eby since December 2022, and before that was Forestry Minister and Minister of Children and Family Development under Premier John Horgan.

In delivering both Budget 2023 and Budget 2024, Conroy emphasized that the BC NDP government would continue to ‘put people first’ with a focus on those who are struggling in today’s challenged economy — including child care, the BC Family Benefit, increases to seniors supports, and more.