Wednesday May 29, 2024 | VICTORIA, BC

Political notes by Mary P Brooke | Island Social Trends

“The Canadian government is doing well but Canadians need support,” said Prime Minister Justin Trudeau during Question Period today in the House of Commons.

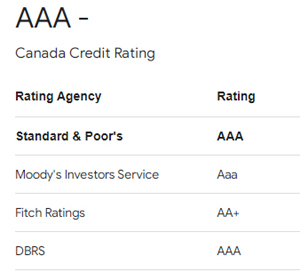

Trudeau was referencing Canada’s financial standing with major credit rating agencies compared to the day-to-day economic realities of citizens.

Stark comparison:

But it was a stark comparison of realities by the Prime Minister today.

It’s good that the country’s financial picture is stable (so that expected programs and services can continued).

The current Canada Credit Rating is AAA with Standard & Poor’s, Aaa with Moody’s, and AA+ with Fitch.

Fitch Ratings said in April 2024 that “the small increase to Canada’s deficit resulting from the latest Federal budget will have a minimal impact on the country’s credit profile”.

But the continued pressures of inflation and interest rates maintained by the Bank of Canada at 5% since July 2023 continue to bite hard on households and small businesses.

The debt of Canadians households continues to be high, and there are notably more people paying only the minimum monthly payment this year compared to 2023, according to TransUnion this week. As well, TransUnion reports that in the first quarter 2024 there was a historic record of 31.8 million Canadians now holding one or more credit products.

“Continued higher cost of living and interest rate pressures led to rising consumer-level delinquencies,” says a May 26, 2024 news release from TransUnion. The aggregated effect of higher consumer credit demand is being met with “restrained lender risk appetite”, which means consumers will have fewer credit opportunities.

Impacts of continued financial strain:

- The cumulative impact of financial strain or distress on households that are overburdened with debt translates into things like people paying higher rent or losing their homes, and reducing their food volume or nutritional intake which will lead to health system load down the road.

- For small businesses it means continued pressure to carry debts (e.g. line of credit and loans) which is a cost that gets passed on to consumers. It also means that some businesses cannot afford to hire more employees or train their current employees.

Eby continues the interest-rate theme:

BC Premier David Eby takes every opportunity he can get to articulate the impact of high interest rates on housing developers and builders, saying that tight housing supply is not being helped by the slow-down related to the carrying-cost of housing development financing.

Most recently that line of commentary from Eby was on Monday (May 27) during media questions at an announcement with Housing Minister Ravi Kahlon about launching an online portal for housing permit applications.

===== RELATED:

NEWS SECTIONS: FOOD RESILIENCE | ECONOMY