Friday December 15, 2023 | VICTORIA, BC [Updated 12:50 pm]

by Mary P Brooke | Island Social Trends

The Bank of Canada will move to holding eight media sessions in 2024 (up from 4). After each rate announcement governor and deputy governor will be available for questions.

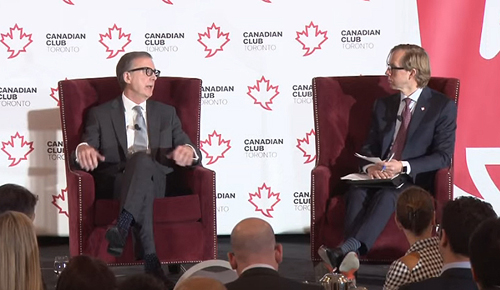

This is part of “adapting” and “communicating more”, says Bank of Canada Governor Tiff Macklem today in his live webcast media availability with journalists.

That was following his lunchtime address to the Canadian Club in Toronto which also was followed by questions from the audience through the host moderator. The full webcasted address is subtitled “The path to price stability“, available online. The speech summary is titled “Lessons learned and looking ahead“.

“Monetary policy works better when people understand it,” said Macklem, itemizing that there will be increased use of “social media, video and TV” for getting out more messaging to the general public.

He adds that “monetary policy is working largely as expected” and hopes that inflation will be “close to target” by the end of 2024.

Macklem said that public confidence has been eroded during the last 21 months (March 2022 to present) in which interest rates have rapidly increased as part of the central bank’s work to contain and reduce inflation. He said there is a “new generation of Canadians” who have experienced the pain of inflation for the first time.

Inflation was high in the 1970s, but without full commitment to keeping it down, became even higher and more painful in the 1980s, Macklem recounted.

Macklem said that when “public trust gets eroded” that the Bank of Canada has to “rebuild that every day”.

Significant progress:

Inflation reached a peak of 8.1% in June 2022 and is presently (as of October 2023) at 3.1%.

Macklem sees this as significant progress but articulates that he is fully aware of the impact on Canadians, in particular the lowest income households.

2024 will “be a year of transitions”, said Macklem. The first part of the year will see growth “close to zero” but at present he suggests that things might turn around in the latter part of next year.

Impact on renters:

Macklem did single out the impact on rent increases in Canada (currently averaging 8.2%), offering a mix of being puzzled and possibly dismayed at how that has impacted so many households across the country.

But people have to pay their rent. With the impact of inflation “everything goes up and there’s no way around it”.

Need more productivity:

Macklem expressed concern about the sag in productivity of small and medium size businesses. Increased productivity is needed across the Canadian economy, in order for a stronger overall economy, he said.

Macklem did not provide more detail on how businesses might become more productive. Though it would seem that the major retail banks would have a lot to do with that, if they offer more flexibility with loan top-ups, and more appetite for risk-taking with new loans and interest rate levels for businesses.

Today the Canadian Bankers Association posted an ad in social media: “When Canadians set goals, Canada’s banks are ready partners. Every step along the way.”

===== ABOUT ISLAND SOCIAL TRENDS:

Island Social Trends post daily at IslandSocialTrends.ca to examine the news for what matters to households, businesses, and communities.

Publishing news insights since 2008 on Vancouver Island (MapleLine Magazine 2008-2010, Sooke Voice News 2011-2013, West Shore Voice News 2014-2020, Island Social Trends mid-2020 to present).

Editor Mary P Brooke takes a socioeconomic lens to local, regional, provincial and national news where there is impact for people here on Vancouver Island. Ms Brooke holds a Certificate in Public Relations and in digital marketing. She has been a business owner in BC since 1995.