Wednesday May 17, 2023 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

The Bank of Canada will be delivering their next Economic Progress Report from downtown Victoria.

Being hosted at the Victoria Conference Centre by the Greater Victoria Chamber of Commerce (GVCC) on June 8, the mid-year economic address will be delivered over lunch to members of the Greater Victoria business community.

“Anticipation is building as Vancouver Island prepares to host its first Bank of Canada public address in almost five years. These events are national news and popular with everyone interested in business and the state of the economy,” said the GVCC in a news release this morning.

The Chamber says it began working two years ago to book a speaker from the Bank of Canada. The demand for their time is high among chambers of commerce, boards of trade and businesses associations across the country. Of course, the pandemic phase interrupted opportunities for travel and in-person events during 2020 and 2021.

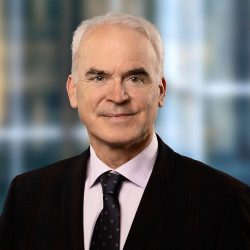

Bank of Canada Deputy Governor Paul Beaudry will unveil the Progress Report speech, which will be simulcast nationally.

Interim news – May 18:

This will come on the heels of a Financial System Review being delivered by Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers tomorrow morning (May 18 / 8 am PDT) online.

A big deal for business:

“This is a big deal for business. There’s huge anticipation ahead of the monthly rate announcement and updates such as the Economic Progress Report,” Chamber Chair Kris Wirk said about the June 8 presentation coming up in Victoria.

“To have the eyes of the national financial press focused on Victoria is a rare opportunity and something that our local businesses don’t often have the chance to experience in-person,” said Wirk in today’s news release.

“It’s an unprecedented time for the global economy and, I think, we’re looking forward to some insight as well as the chance to be in a room full of ambitious business people to share this experience,” said Wirk.

Big venue:

To accommodate the interest from Greater Victoria’s business community, The Chamber is hosting the event at the Victoria Conference Centre, partnering with Odlum Brown, the City of Victoria and Grant Thornton.

Day-after interest rate announcement:

The report by Deputy Governor Beaudry will come the day after the Bank makes its next interest rate announcement on June 7.

This week economists were somewhat surprised at seeing inflation rate increase (to 4.4%) after heading downward for months; that was the first rise in the consumer price index since it peaked at 8.1% in June. Grocery inflation is still high, impacting most Canadians in noticeable if not challenging ways.

According to a report by The Financial Post yesterday:

- Month-over-month, the CPI was up 0.7 per cent, higher than the forecast 0.4 per cent gain.

- Inflation drivers were mortgage interest costs, which were up 28.5 per cent from a year ago because of higher interest rates. Rents, up 6.1 per cent, also pushed up the headline rate.

- Grocery prices were up 9.1 per cent from a year ago, cooler than the 9.7 per cent increase in March.

- Gas prices rose 6.3 per cent on the month, though they are still down 7.7 per cent from a year ago when oil prices soared at the onset Russia’s invasion of Ukraine.

- The average of the three core measures of inflation tracked by the Bank of Canada cooled to 4.7 per cent in April from 4.97 per cent in March.

The Bank of Canada has been increasing their rate (upon which all other interest is based throughout the economy) over the past year in the hopes of achieving their goal to return inflation to the range of 2% to 3%.

Beaudry will speak about recent developments in the Canadian economy and the implications for monetary policy, followed by questions from the audience and a media availability.

“We don’t know any of the specifics about what the report will say, of course, but we do know that the information will be significant to many of our businesses,” said Wirk, partner with the accounting firm Dusanj + Wirk.

Possible solutions:

The economic reality for most Canadians has been slowing changing for decades, and in the last few years has reached a level of challenge for many and near impossibility for some.

It will be interesting to see how the Bank of Canada aims to see its actions or decisions have an impact on the major concerns of most Canadians including the cost of housing, food, interest rate overhead (for individuals and small businesses), and the overall cost of living.

The Bank of Canada operates independently from government, but their actions combine to create real scenarios for individual Canadians and small businesses to grapple with.

Deputy Governor Beaudry:

Paul Beaudry was appointed Deputy Governor of the Bank of Canada, effective February 2019. In this capacity, he is one of two deputy governors responsible for overseeing the Bank’s financial system activities. In 2021, Mr. Beaudry became responsible for the Bank’s analysis of international economic developments in support of monetary policy decisions—serving as the Bank’s G7 and G20 Deputy.

As a member of the Bank’s Governing Council, he shares responsibility for decisions with respect to monetary policy and financial system stability and for setting the strategic direction of the Bank.

At the time of his appointment to the Bank of Canada, Mr. Beaudry was Professor at the University of British Columbia’s Vancouver School of Economics.

===== ABOUT ISLAND SOCIAL TRENDS:

Island Social Trends is professional regional journalism presented at islandsocialtrends.ca. Fully online as a daily news portal since mid-2020, Island Social Trends emerged from the path of previous print publications in the west shore: MapleLine Magazine (2008-2010), Sooke Voice News (2011-2013), and West Shore Voice News (2014-2020).

Since 2008, journalist and editor Mary P Brooke has taken a socioeconomic lens to reporting and analyzing the news of the west shore and south Vancouver Island region, including BC and national news impacts. [See Island Social Trends Politics Archive]. She has covered the details of local, provincial and federal elections since 2008.

Ms Brooke reported on-site at the Council of the Federation (Canada’s Premiers) conference for two days about health care in Victoria in July 2022.

As of 2023 Mary P Brooke reports with the BC Legislative Press Gallery.

Mary P Brooke has also focused on news of School District 62 (Langford, Colwood and Sooke) at the board level since 2014 [see Island Social Trends Education archive] and has covered West Shore Parks & Recreation over the years (particularly the transitional years 2014-2020, and again starting 2023). During 2020 and 2021 she reported daily on BC’s COVID pandemic news to build the ongoing COVID pandemic archive. Since 2021 she has been building a Food Security news archive. She is now covering the 2023 Langford-Juan de Fuca by-election.

Watch for the renewed print edition of Island Social Trends (formerly West Shore Voice News) in summer 2023. Advertisers welcome – inquiries. | How to be a Premium Subscriber